Investment Thesis

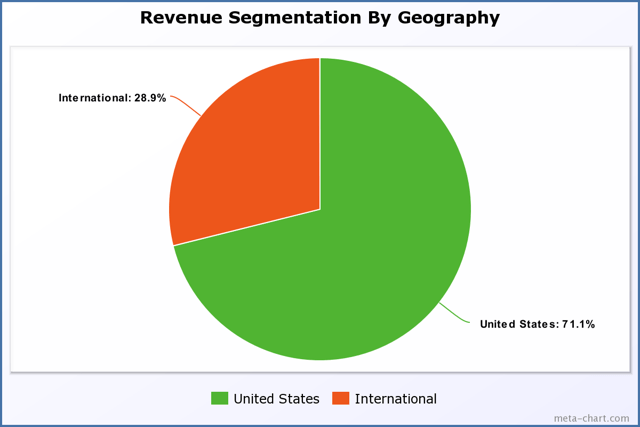

Foot Locker Inc. (NYSE: NYSE:FL) is a global retailer of athletic-inspired shoes and apparel with chains in the US and more than two dozen other countries. The company operates in two segments, North America and International. But it is heavily dependent on the US market which accounts for more than 70% of its total revenue.

Source: Data from the company's 10-K report

Foot Locker is a reasonably valued and established dividend growth stock. The company has been one of the higher quality specialty retail stocks over the last few years. Of late, its share prices have been falling as a consequence of a disappointing earnings report but Nike's (NKE) recent quarterly results boosted the stock. The company is financially robust and currently undervalued. While other brick-and-mortar businesses have fumbled, the revenue of this retail chain has continued to grow.

Recent Developments

For Foot Locker, the major part of its consumers constitutes the young generation and thus in order to stand out against its competition the company is carrying out several strategic steps to tap into the youth culture. The company is exploring efficient ways to build traffic and create some buzz. One of those steps includes increasing its digital footprint. The athletic-goods empire has invested in a host of digital-first companies, including placing a $100 million into GOAT, which operates an online resale marketplace for sneakers. It has also invested millions in businesses like women's activewear brand Carbon38 and children’s apparel company Rockets of Awesome. Foot Locker is working vigorously towards elevating the customer experience be it in-store or on digital platforms. In order to encourage customers to visit its brick-and-mortar locations, Foot Locker's recent power store in Washington Heights has seen collaboration with local businesses, artists, and influencers and a double-down on brand exclusivity by offering curated local brands that will exclusively be held at the location.