Introduction

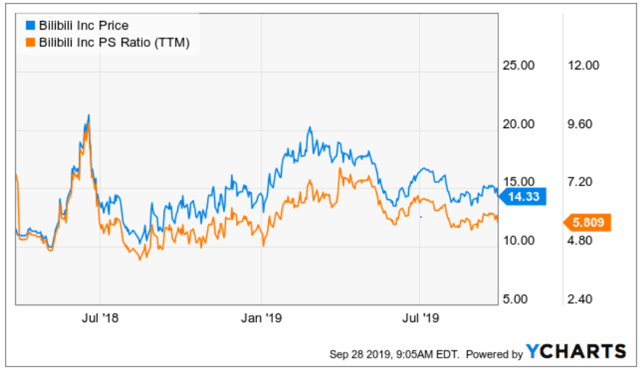

In our first article on Bilibili Inc. (NASDAQ:BILI), we will primarily focus on the mobile games segment of the company. BILI’s share price is currently down -1.78% on a year-to-date basis and is currently trading at $14.33 per ADS. We believe that the company is undervalued due to increased uncertainty over its mobile games business combined with negative sentiment triggered by the ongoing U.S.-China trade dispute. Furthermore, we are slightly surprised that the ongoing trade dispute has such a negative impact on Chinese software companies. Additionally, BILI’s strong business performance will be supported by the increasing user engagement of online entertainment content in China. Our valuation model suggests that the company should be trading between $25.65 and $35.54 per ADS. Given that the potential upside far outweighs the downside, we recommend a buy into this company.

Management

It is our belief that BILI has a strong and experienced management team that will help the company to maintain a leadership position. In our opinion, the leaders of the company possess deep domain knowledge of the online entertainment industry, thus making them well-positioned to monetize on the passion or interests of Generation Z users. Consequently, we believe that will create a strong value for BILI’s shareholders in the long run.

Mr. Rui Chen, the Chief Executive Officer and Chairman of the company, is a well-known serial entrepreneur in the Chinese software industry. He had previously served in senior management of Kingsoft (OTCPK:KSFTF) and has co-founded Cheetah Mobile (CMCM). Overall, he has accumulated more than 15 years of experience in the internet and technology-related industries in China.

Xin Fan, the Chief Financial Officer has a very strong financial expertise from his previous work in the big-four accounting firm KPMG. He was also previously a finance director of NetEase (NTES) for more