Coda Octopus Group, Inc. (NASDAQ:CODA), with a market cap of $90 million, is a micro-cap niche player in underwater sonar imaging technologies with applications for various industries, including military and defense, oil & gas, mining, and offshore construction. The company with a 25-year history claims to be a leader in its market segment with an established history of developing products having cutting-edge performance. We think CODA here at $8.00 is a buy following a deep pullback in its share price in recent months, as the fundamentals remain positive for an overall solid company. CODA is profitable and has a clean balance sheet with a net cash position, while presenting steady growth. This article recaps the recent earnings release and our view on where the stock is headed next.

(Source: Finviz.com)

CODA Background

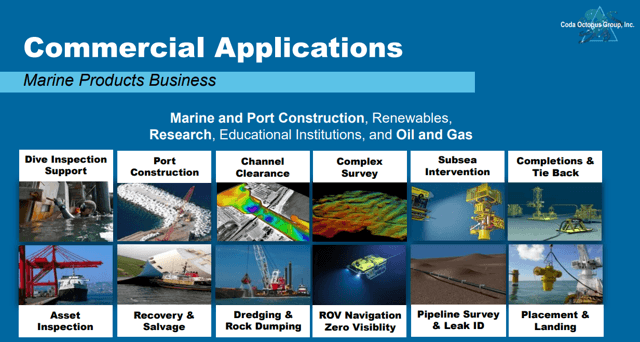

Coda Octopus Group operates two segments, including Marine Technology Business "Products" and Marine Engineering Business "Services". The products are used in the underwater construction market, offshore oil and gas, wind energy industry, and in the complex dredging, port security, mining and marine sciences sectors. CODA considers the addressable global sonar market to be $2.5 billion, where it currently has a 0.49% market share, highlighting the growth opportunity.

CODA commercial applications. Source: Company IR

Among the services segment, these are mainly military applications like mines detection and underwater instrumentation, which the company commercializes through its "Martech" and "Colmek" units. CODA is a subcontractor to the U.S. Department of Defense and also counts on larger players like Raytheon (RTN) and Northrop Grumman (NOC) as customers for its proprietary technologies. Growth has accelerated in recent years, with revenues reaching $25 million over the trailing twelve months. Despite ongoing research & development investments, CODA has been profitable, reporting positive net income every year since 2011.

Q3 Earnings Recap

CODA reported its fiscal