VBI Vaccines (VBIV) has been on my radar for a while due to its Hepatitis B vaccine being a potential competitor to Dynavax's (DVAX) HEPLISAV-B, which I am invested in. Although I believe HEPLISAV-B has a significant advantage over other vaccines, I never decline a shot at a value investment, even if it is a competitor. VBIV's Hepatitis B vaccine, SCI-B-VAC, revealed mixed results in June and the market punished the share price as a result. Despite SCI-B-VAC being approved in several countries and regions outside the U.S., the market is hung-up on the two-dose efficacy. Personally, I believe the market has taken the selling too far and has discounted VBIV without the full dataset.

I intend to review SCI-B-VAC's data and provide my views on why investors should be optimistic about its prospects. I take a look at the rest of the company's pipeline and how investors should keep an eye out for some upcoming catalysts. Finally, I present my case for a speculative buy in VBIV.

June Data

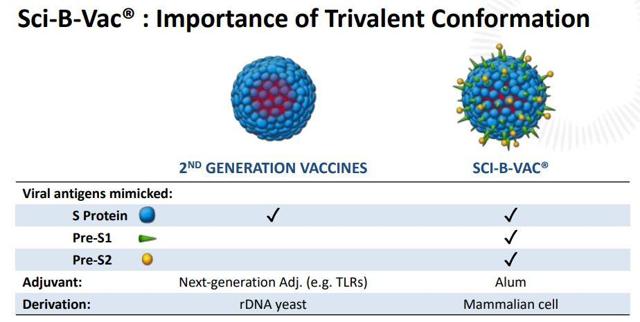

Back in June, VBIV reported positive top-line data from its PROTECT Phase III for SCI-B-VAC. VBI's trivalent vaccine was able to demonstrate superiority to GlaxoSmithKline's (GSK) standard-of-care Engerix-B in several categories, however, the stock was hammered because the two-dose SCI-B-VAC protocol did not achieve statistical non-inferiority to three doses of Engerix-B in all patient populations. HEPLISAV-B's two-dose was able to demonstrate superior efficacy to Engerix-B and is already on the market. The two-dose protocol should help address the ~3/4 of adults who failed to get the final Engerix-B shot.

Figure 1: SCI-B-VAC Advantages (Source: VBIV)

The study hit both of its co-primary endpoints of the non-inferiority of SCI-B-VAC seroprotection rates matched with Engerix-B in all patients ≥18 years old, and superiority of SCI-B-VAC's seroprotection in patients ≥45 years old.

Moreover, the