It must have been tough for Micron Technology’s (NASDAQ:MU) shareholders to swallow a perfectly fine 4Q earnings releases which turned into a 12% hit on the stock. The stock price seems to be in such a disarray in the last few days, as investors are anxiously searching for signs of bottoming in Micron’s financials. The common wisdom behind this line of thinking is that since share prices are determined by fundamentals, predicting future financials will help to predict future stock prices. In this note, I offer an alternative perspective: In a rational world, the stock price should be forward-looking. Thus, current stock price itself is a predictor of the future fundamental. If this argument has merit, you would expect that stock prices should lead the future (actual) fundamentals, and the obvious implication is that the market has no need to look for signs of bottoming in financials if the stock prices already bottomed.

Micron Prices Lead Micron Forward Financials

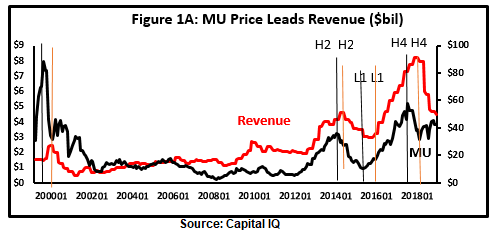

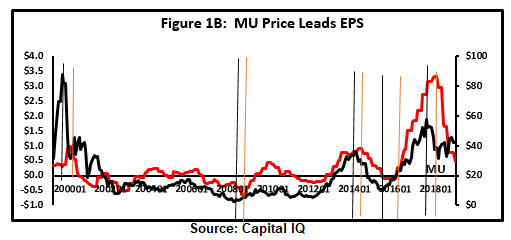

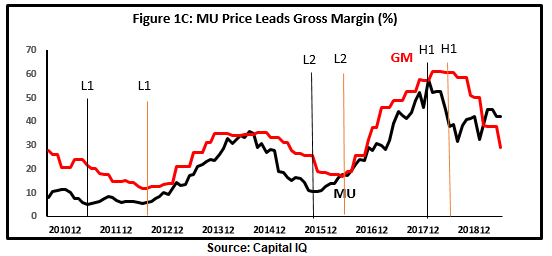

To see if this line of thinking has promise, I need to examine the inter-relationship between Micron stock prices and actual fundamentals. Over the last 20 years, Micron stock price movement has led the relevant financial metric’s move especially near the top and the bottom. For example, as shown in Figure 1A through Figure 1C, Micron’s stock price tends to lead its future revenue, EPS, and gross margin, as MU’s top (bottom) indicated by the black line is always ahead of fundamental’s top (bottom) indicated by the red line.

The reason why stock price leads future financials seems obvious because a rational stock market should always be forward-looking. The only assumption here is that the market price on average can predict the actual outcome.

The message that MU price leads actual financials is more than just an interesting pattern but suggests