Lead author: Frank Wang.

Source: sherdog.com.

Overview

Wingstop (NASDAQ:WING) is an American franchisor and operator of restaurants that specialize in cooked-to-order, hand-sauced, and tossed chicken wings. It offers 11 flavors on bone-in and boneless chicken wings and tenders and paired with fresh-cut, seasoned fries and made-from-scratch Ranch and Bleu Cheese dips. Wings, fries, and sides together generate approximately 93% of Wingstop's sales. The Company is primarily a franchisor, with approximately 98% of Wingstop's restaurants currently owned and operated by independent franchisees.

Franchise Model

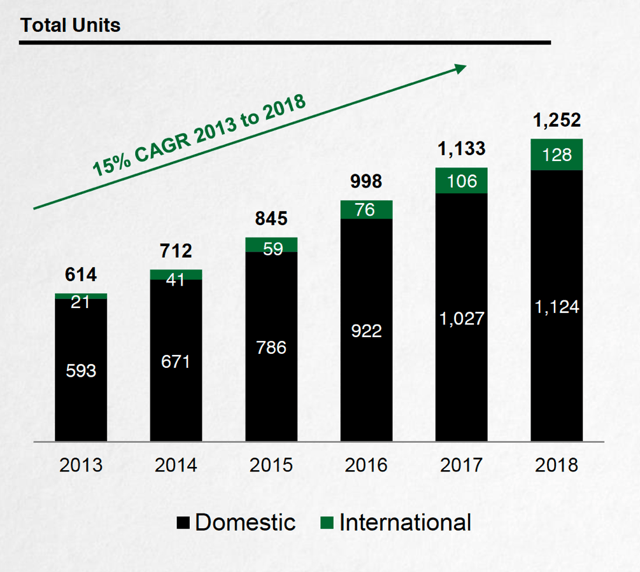

As of June 2019, Wingstop now operates a total of 1,252 restaurants, with 1,124 units in domestic and 128 units overseas. Domestically, the majority of the restaurants are located in Texas (30%), California (23%), and Illinois (6%). Internationally, Mexico and Indonesia markets host 82% of the total overseas restaurants.

In the US, the franchisee pays a franchise fee of $20,000, and a development fee of $10,000 for each new restaurant opened. Most franchisees also pay the royalty of 5%-6% of their gross sales net of discounts to the company. Besides, Wingstop charges 3%-4% of the gross sales net of discounts for its national advertising fund. Finally, franchisees are required to spend at least 1% of their gross sales on local advertising and promotions.

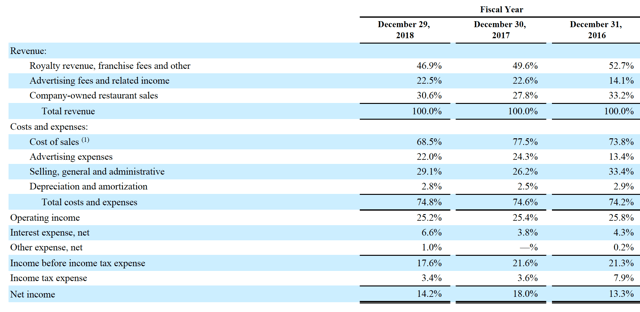

As for the site, Wingstop gives general guidelines but does not own or rent any real estate to franchisees. In the past three years, about 50% of Wingstop's gross revenue comes from royalty revenue and franchise fees, 20% comes from advertising fees and related income, and 30% from company-owned restaurant sales (see below).

Source: Wingstop 10-K, 2019

As you can see below, Wingstop increased its restaurant base by 15% on average annually since 2013.

Source: Investor Presentation 2019

Valuation

Source: Yahoo Finance; data as of 10/3/2019.

As you can see above, the share price of