Based on a series of internal initiatives and a favorable operating environment for warehouse clubs, BJ's Wholesale Club Holdings (NYSE:BJ) has exhibited positive business performance. Trading at a large discount to Costco (COST) and with a relatively cushioned business model against a potential economic slowdown, BJ's Wholesale Club is a good alternative in the consumer sector in light of current environment.

Background and Business Overview

BJ's is a warehouse club operator on the east coast of the United States, with 217 clubs across 16 states and 5.5 million members paying annual fees.

The company has developed its business model using a strong value proposition, underscored by price advantage over traditional groceries, an optimized selection of SKUs and a series of conveniences for memberships.

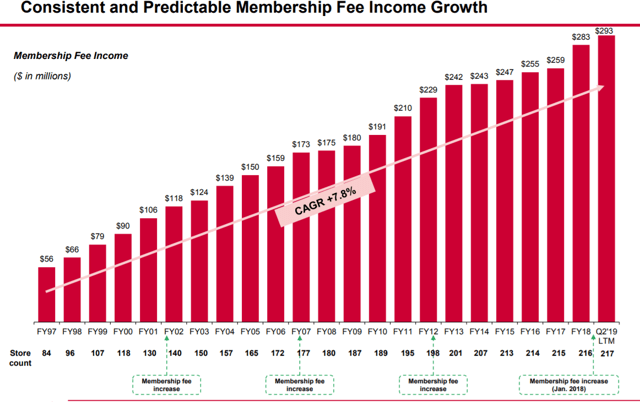

Over the years, this model has produced consistent growth in membership fee income since the early years of the company in 1984, as illustrated below:

Source: BJ's Investor Presentation September 2019

This trend has persisted in the recent quarter with growth of 6%, supported by increases in members, higher tier memberships and the renewal rate, which has jumped from 84% in 2015 to 87% in 2018.

This positive development is also reflective of the improved quality of the company's membership base, as it has lately focused on the paid first-year membership offers rather than trial offers, which now represent less than 1% of total sales.

Instead, strategic efforts have been centered on high value options, such as co-brand credit cards, which have significantly boosted the engagement from members, as evidenced by strong renewal rates and a high life-time value. This high-tier membership has increased rapidly over the recent 3 years and represents now 27% of the membership base compared to 21% in 2017.

While this push toward high-tier membership has been backed by technology investments at the