Investment thesis

Cabot Oil & Gas (COG), one of the most profitable natural gas producers in the Marcellus shale play, has seen its financials weaken in 2019, as the oversupplied U.S. natural gas markets weighed on gas prices.

Yet, the stock price has recently stabilized after the disappointing 2Q2019 earning release, which confirmed that COG's revenue stream and free cash flows are on a declining path.

In spite of that, COG's profitability is unmatched in the Marcellus shale play, and its decision to acquire additional acreage on its eight-well pad will boost capital efficiency, increasing output growth and enabling the share price to recover from its recent collapse.

Source: TradingView

While COG's natural gas output is still growing healthily, weak natural gas markets continue to weigh on the company's revenues

In its last quarterly earnings release, COG beat earnings expectations by $0.03 to $0.36 per share, whereas revenues slightly disappointed investors, with a $5.6m miss to $470.5m.

Concomitantly, the company improved its natural gas output, up 4.4% (q/q) to 213.8 Bcf, an increase of 24% on a comparable quarter basis. While the company has outperformed market expectations in recent years, worries concerning its ability to boost the production level are mounting, as COG cut its annual production growth guidance to 16-18% from 20% previously, somewhat explaining its deceiving stock performance.

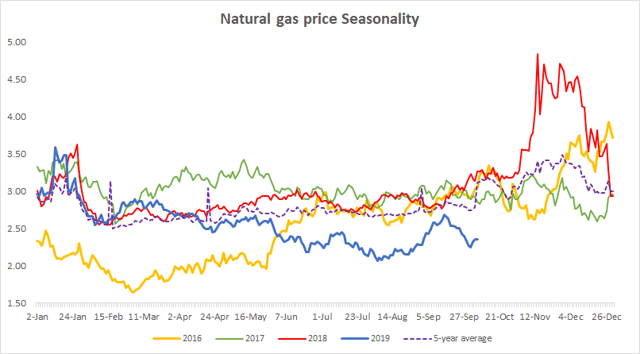

Besides, average price realizations including hedges dipped robustly, down 32.2% (q/q) to $2.27 per Mcf, further increasing investors' disappointment. More importantly, natural gas prices averaged $2.32 in 3Q2019, indicating that the company might be under additional pressure ahead of the upcoming earnings release.

Source: Quandl, Oleum Research

This is mostly due to the steady natural gas supply ramp-up and a lagging aggregate demand that enabled the complex to erase early year low storage levels. Indeed, by the end of the 2019 winter