Prudential Financial (NYSE:PRU) is a Fortune 500 company that offers life insurance, annuities, and a host of financial services from retirement to mutual fund and even asset management. The company has existed for 140 years and operates globally. With strong results in almost every division, the company has not seen its shares participate in the overall market rally. While interest rates are expected to rise, Prudential should further benefit and see growing earnings all while reducing shares outstanding and increasing its already attractive dividend. Investors should entertain opening a position in Prudential as they are buying $1 worth of assets for $0.88.

Prudential Operating Performance

Prudential has been operating well. Results in the recent quarter were strong as we will review below.

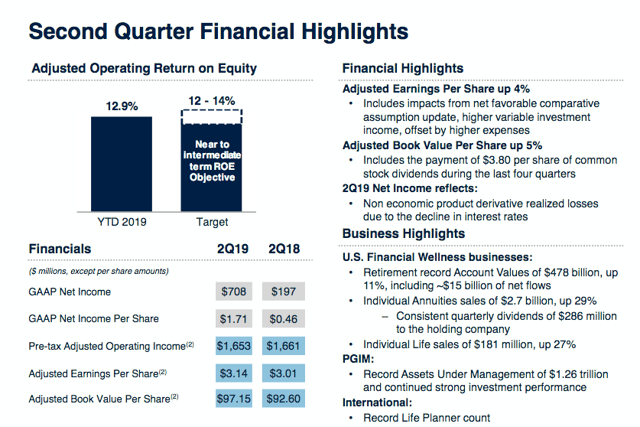

Source: Prudential Earnings Slides

Adjusted earnings saw growth of 4%. Book value also rose to $113.59 excluding accumulated other comprehensive income, while adjusted book value saw a rise as well to $97.60. With the shares currently trading around $86 it means the company is trading at 0.6x book value of $150 per share and only 0.88 times adjusted book value.

Assets under management grew to $1.497 trillion versus $1.388 trillion for the year-ago quarter. This is important as it shows the company still has the ability to attract client assets.

A few divisions that saw declines were "Individual Annuities Segment", with operating income down 9%, "Individual Life Segment" saw an operating loss of of $135 million. Much of the negativity in the report was attributed to changed assumptions from annual reviews. The retirement division, U.S. financial wellness division, international insurance division, life planner division and most others saw increases in income.

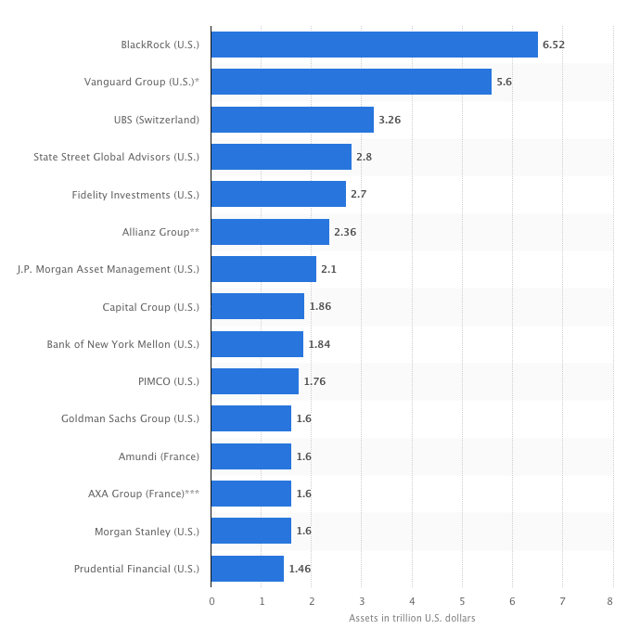

The company saw its assets under management grow to $1.338 trillion, this puts it among the top companies in the world for AUM.

Source: Statista