MobileIron (MOBL) is a reasonably obscure player in a rapidly evolving UEM (unified endpoint management) market. There's been a couple of strategic leadership decisions to re-accelerate growth and drive more shareholder value. This includes the revision of its go-to-market narrative as the leader in Zero-Trust mobile solutions and the institution of a share buyback program. As a result, MobileIron is poised to add more points to its valuation multiple if its growth initiatives come to fruition.

Source: VMware

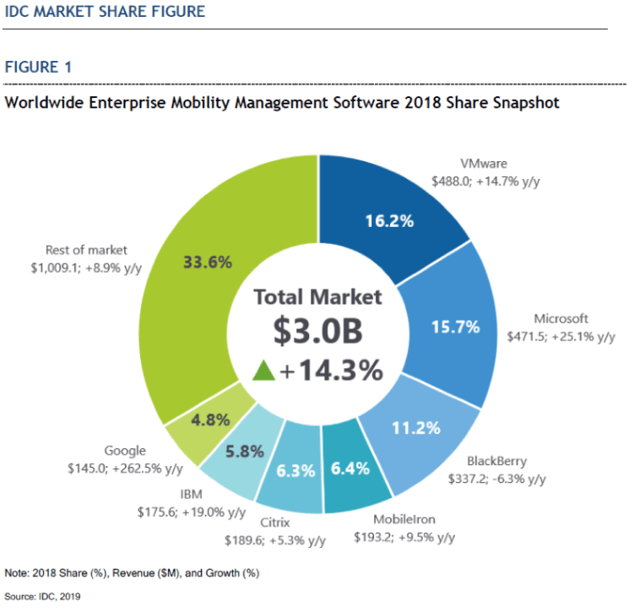

The chart above gives a broad overview of how MobileIron stacks up against the competition in the UEM market. The UEM market aims to solve the problem of secure access to enterprise applications for mobile users from their mobile devices.

Because a lot of workers prefer to work from their devices while sometimes gaining access to enterprise tools from remote locations, it's important to secure both their devices and their access to these business tools. In 2018, IDC valued the entire market at $3 billion, a 14% growth from the previous year. The bulk of these gains were driven by tech giants such as Google (GOOG) (GOOGL) and Microsoft (MSFT), who are more than interested in this space. These tech giants are known to dabble in a lot of promising niche tech spaces. They have the resources and talents to compete, and they often resort to acquisitions if they can't catch up. This means pure plays like BlackBerry (BB) and MobileIron have to up their game in order to preserve market share and compete favorably without sacrificing margins. This is a tough feat to achieve.

In the case of MobileIron, management has been able to compete favorably while improving profit margins. However, this has come at the cost of a decelerating growth rate. This means MobileIron doesn't get to enjoy the lofty valuation ratio of other