Dividend growth investing is a popular and largely successful approach to generating wealth over long periods of time. Investors typically do well focusing on companies with long streaks of dividend increases in part because of the positive qualities a business needs in order to be able to continually afford what is ultimately a cash layout to shareholders. However, many of the companies known as "dividend champions" - those with 25 consecutive years (or more) of dividend growth - are mature companies. By identifying strong companies earlier in their life cycle, we can benefit from strong total returns while these companies build their dividend growth reputation. We will be spotlighting numerous dividend up and comers to identify the best "dividend growth stocks of tomorrow."

Overview

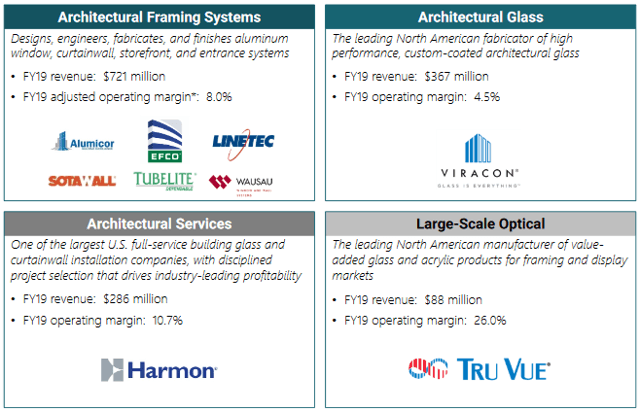

Apogee Enterprises, Inc. (NASDAQ:APOG) designs and manufactures glass and metal products and systems used in high-end construction such as for skyscrapers, libraries, convention centers, concert halls, and more. The company sells into the US, Canada, and Brazil with approximately 95% of revenues generated from customers in North America.

Source: Apogee Enterprises, Inc.

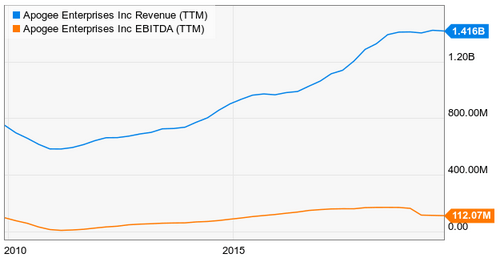

The company operates in four segments (shown above) and combine for approximately $1.4 billion annually. Despite an economic upturn following the recession, Apogee Enterprises has grown quite modestly for an economically sensitive business. Over the past decade, revenues have grown at a CAGR of 4.25%, but earnings have contracted at a rate of -1.10% per annum.

Source: YCharts

Fundamentals

To dig into this further, we will look at some key operating metrics that will help us identify some of the strengths and weaknesses within this business. This will help us explain the company's lack of earnings growth, as well as gauge Apogee Enterprises' future potential for investors.

We review operating margins to make sure the company is consistently profitable. We also want to invest in