As someone who depends on dividends to pay my bills and fund my lifestyle I am always looking for ways to boost my income. Recognizing that I started following Annaly Capital (NYSE:NLY) a few months back when their 12% dividend attracted my interest. At the time I thought it might be too good to be true and wrote about how the dividend might not be sustainable, much to the chagrin of some readers, but shortly after that they cut the dividend. Now sitting at an 11.5% yield it is still quite generous, but I am still asking the same question: Is it sustainable and should the conservative dividend investor be avoiding this opportunity?

Mortgage backed securities have a rather checkered past

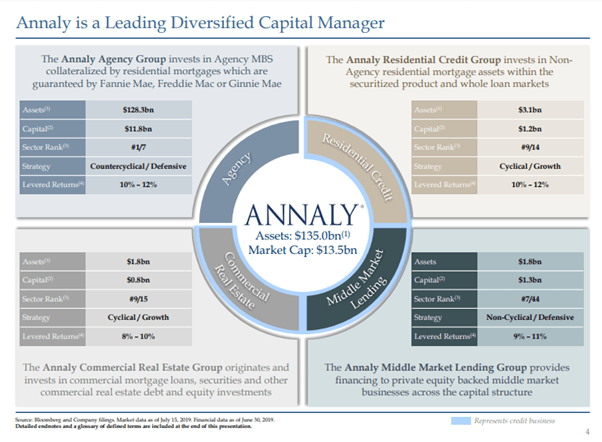

Annaly Capital Management, Inc. is a diversified capital manager that invests in and finances residential and commercial assets. The company invests in various types of agency mortgage-backed securities, non-agency residential mortgage assets, and residential mortgage loans; and originates and invests in commercial mortgage loans, securities, and other commercial real estate investments. It also provides financing to private equity-backed middle market businesses; and operates as a broker-dealer.

Mortgage backed securities have a rather checkered past considering they were the instrument that triggered the Great Recession from 2007-09. During the financial crisis investment banks were bundling individual mortgages, then offering investors the opportunity to trade them as securities with the mortgages forming the underlying asset base. Unfortunately the securities were being traded at significantly higher valuations than the underlying assets, which eventually caused a meltdown in the market. Regulations have tightened up many of these issues, but I still believe they present a risk component you don’t see in traditional banking and may be difficult for many investors to understand.

The challenge that I have with this market is