L Brands (LB), founded in 1963, owns Victoria’s Secret, PINK and Bath & Body Works. The Company operates nearly 3,000 company-owned specialty stores in the US, UK, Ireland, Canada and Greater China. I believe that all their brands, including Victoria’s Secret which is currently struggling, have tremendous long term potential, with significant growth opportunities in North America and internationally.

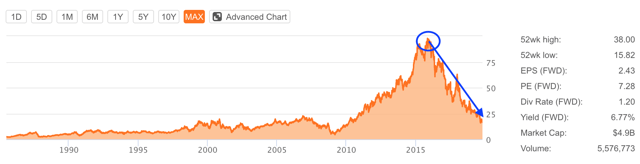

The share price has fallen by more than 80% since its peak in 2015, from $95+ to below $18 (at the time of writing). To be fair, LB is not the only struggling retailer, but I believe the drop has gone too far.

I am not claiming that we have found rock bottom, but I believe the current share price is factoring in a lot of negativity and fear.

Decisive Actions

The Company has taken actions to turn the ship around. Some include:

- closing Henri Bendel and selling La Senza - eliminating ~$74M in annual operating losses

- reducing the dividend by 50% to free up $325M per year in cash flow for debt reduction, etc

- strategically closing, selectively opening and remodeling stores

- appointing Amy Hauk to lead PINK and hiring John Mehas to run Victoria's Secret Lingerie

- Continuing to invest in online/Direct business

- Continuing to refresh the Board of Directors

Promising Brands

It is fair to say that a turnaround in Victoria's Secret will be a major driver in cash flow growth. I believe in the long term potential of Victoria's Secret, which has lost its way in recent years. For instance, the Victoria's Secret brand is leading in social media (~65M Instagram followers, ~29M Facebook fans, ~11 million Twitter followers), has more than 400M store visits per year, and ~$1bn website visits annually, and ~$4bn in global Lingerie retail sales.