Mettler-Toledo International Inc. (NYSE:MTD) is a global instrument company with a solid history of revenue and earnings growth. The company operates with high margins, but its debt level continues to increase, so I’m on the sidelines.

Financials

Mettler-Toledo has produced solid revenue and earnings growth over the last decade. The company operates with high margins. The profit margin is 18% with a return on equity of over 80%. However, Mettler-Toledo tends to operate with fairly high debt levels. The company’s total liabilities represent 77% of its total asset value. This figure has increased from 57% over the last five years. Since 2014, the long-term debt carried on the company’s balance sheet has tripled from $336 million to $1.09 billion.

Mettler-Toledo’s 2020 forward PE multiple is 27.5x with a stock price of $698 and its trailing PE multiple is 32.4x. The company’s book value multiple is 34.1x.

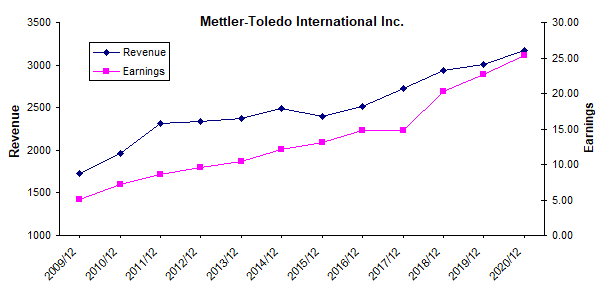

The chart below visually shows Mettler-Toledo’s revenue and earnings trend over the last decade along with the next two years of consensus forecasts.

Mettler-Toledo data by Morningstar.com

Mettler-Toledo data by Morningstar.com

As the above chart shows, Mettler-Toledo’s revenue and earnings have steadily increased and the forecasts show this trend continuing through to 2020.

Over the last decade, Mettler-Toledo’s revenue has increased at an average rate of 6.1% per year and its earnings have increased at an average rate of 16% per year. The forecasts are for revenue growth of 5.3% and earnings growth of 12% for 2020.

Business Model

The Mettler-Toledo is a global company that manufactures precision instruments for the laboratory, industrial and manufacturing industries. The company’s segments include Laboratory, Food Retail, Core Industrial and Product Inspection.

The company’s growth is largely organic with only two acquisitions over the last decade. The acquisitions include Biotix Inc. acquired in 2017 (Biotix manufactures laboratory consumables) and Henry Troemner