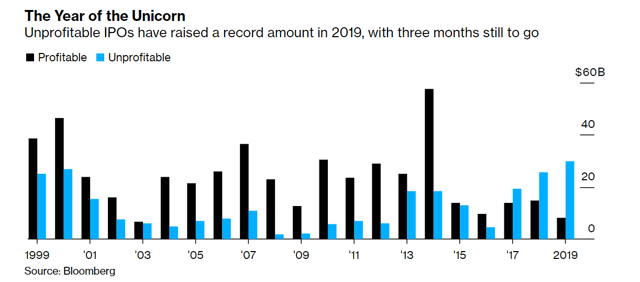

It's been a busy year for the IPO space, with a record amount of money raised for unprofitable initial public offerings to date. This year's $30 billion raised already outpaces the record set in 2000 at roughly $25 billion, and we still have just over two months to go in the year. GSX Techedu (GSX) is one of the newer names that debuted in June, and fortunately, the company is profitable with $0.15 in earnings per share expected for FY-2019 and estimates of $0.44 in FY-2020. While this at least separates it from the heap of unprofitable IPOs, the company's valuation is currently about as lofty as it gets. At its current price to sales ratio, it is knocking on the door of some of the valuations we saw in the 1999 Tech Bubble. Based on this, I see the stock as high-risk, high-reward, and one worth avoiding.

Palantir (PALAN), Postmates (POSTM), Robinhood, and Airbnb (AIRB) remain on deck without set dates yet for their debuts, but it's safe to say that we will exceed the prior record set in 2000 by at least 25%. We are currently sitting at over $30 billion raised for unprofitable IPOs this year, and the ratio of profitable to unprofitable IPOs is the most skewed it's been in the past twenty years. As the above chart shows, it's hard to argue against us having a reasonable dose of animal spirits in the IPO market. Despite 1999 and 2000 being nearly on par with 2019 for money raised for unprofitable IPOs, the ratio of profitable to unprofitable IPOs was roughly 1.5 to 1 during that period. In 2019 thus far, we've got a significant divergence from this statistic. Not only has more money been raised for unprofitable IPOs, but the ratio of profitable to unprofitable IPOs has sunk to 0.25 to 1. This enthusiasm for the IPO market