Source: duluthnewstribune.com

Investment thesis

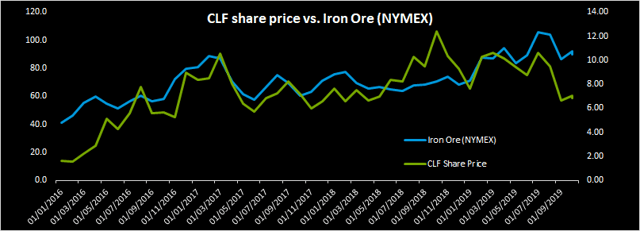

Cleveland-Cliffs (NYSE:CLF) operates in a highly cyclical industry where the company is a price taker. As a result, investors' sentiment towards the stock correlates with exogenous factors such as the macroeconomic environment, trade talks, supply & demand of steel, and pellet premiums.

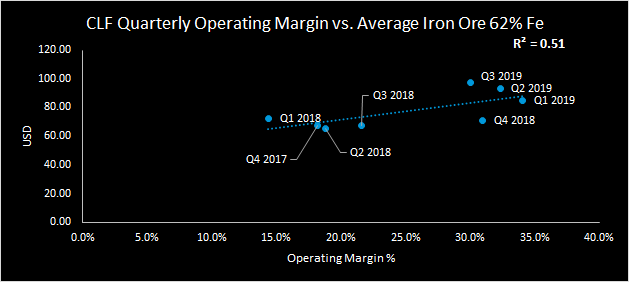

Source: authors' calculations based on data from Cleveland-Cliffs 10-Q filings and Markets Insider

Such variations in investors' sentiment present opportunities for long-term investors as emotional biases towards the industry and the stock often lead to CLF stock price deviating from its fair value both on the up and the downside.

Source: authors' calculations based on data from Yahoo!Finance and Markets Insider

As short-term sentiment deteriorates due to transitional fall in Atlantic pellet premiums and Hot-Rolled Coil Steel prices, long-term oriented investors could benefit from the low price multiples that CLF trades on. The company offers some distinct and long-lasting competitive advantages that should benefit long-term shareholders.

Polluting Steel Industry

To properly evaluate Cleveland-Cliffs' long-term competitive advantages, we have to take a brief look at the steel industry first.

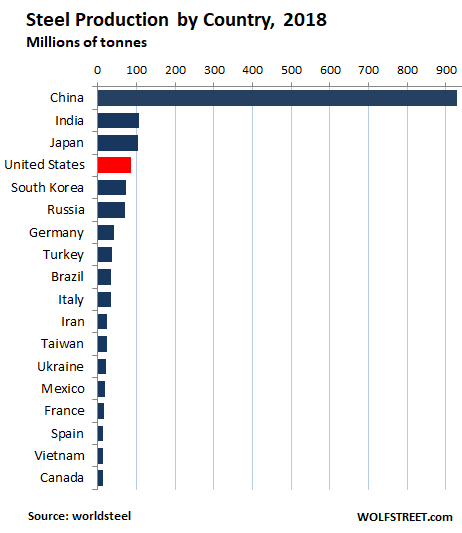

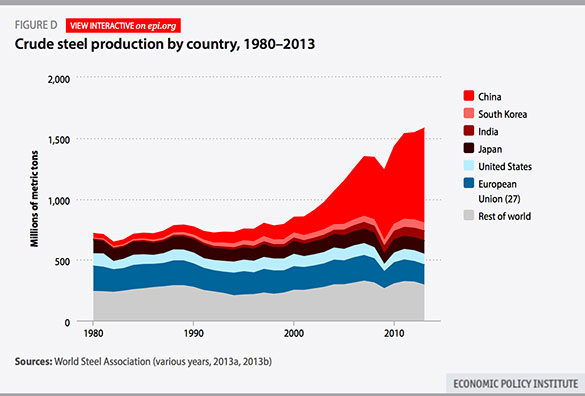

China has become the number one steel producer of the world by a very wide margin.

The steel industry in China took off about 20 years ago.

Source: agmetalminer.com

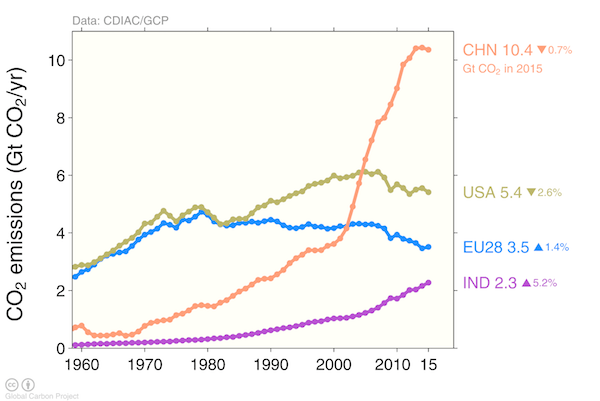

That shift in production, however, has come at a high price for the environment. Steel plants are now the biggest environmental concern for the Chinese government after the country took steps to curb emissions from coal plants.

Source: climatechangenews.com

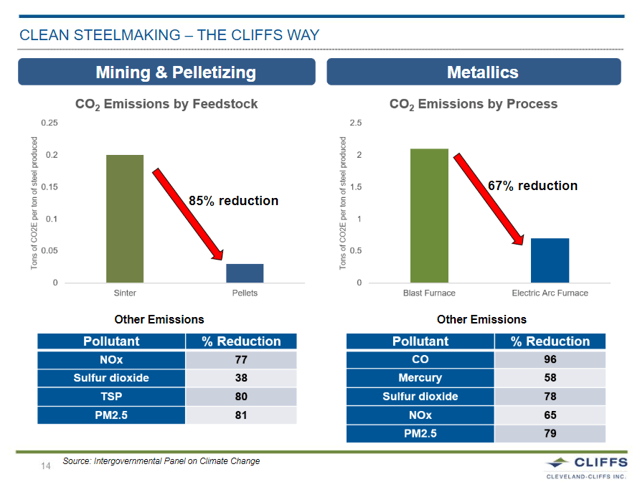

As the CEO of Cleveland-Cliffs points out numerous times in his presentations, sinter plants used in China are the worst choice from the environmental point of view.

Source: Credit Suisse Basic Materials Conference Sept 2019

Not surprisingly then, the Chinese government has begun to work towards lowering the emissions from its steel industry. No doubt a process that is