Should Amazon (AMZN) Purchase F5 Networks (NASDAQ:FFIV)? - was my working title for this article. F5 Networks has a strategic collaboration agreement with Amazon Web Services [AWS] for using cloud-native application workloads. Both are headquartered in Seattle, Washington. And F5’s stock quote is getting cheap.

A week ago, the companies announced yet more innovation as they upgraded the ability of AWS customers to quickly create applications seamlessly. Chad Whalen, Executive Vice President, Worldwide Sales at F5, reported:

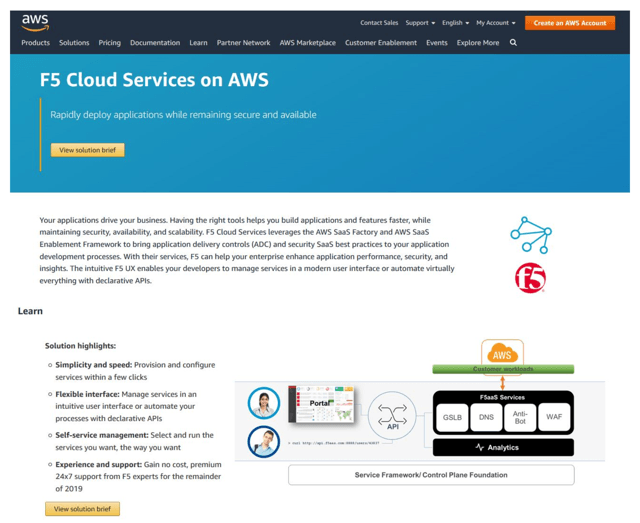

F5 has collaborated closely with AWS for years, most recently on our SaaS offering, F5 Cloud Services. Together with AWS, we are providing a set of solutions that help enterprises deploy apps quickly and securely, while ensuring they are performant and comply with policy. This aligns with our strategy of supporting modern DevOps practices and serving engineering teams with capabilities that create the most efficient path from code to customer.

Image Source: AWS Amazon Website

Image Source: AWS Amazon Website

F5 Networks develops and markets application delivery networking products that optimize the security, performance and availability of computer servers, storage systems and applications. The company's primary technology is Traffic Management Operating System [TMOS], enabling companies to inspect, analyze and act on traffic content. The company is basically an expert in computer networking and the review of cloud traffic trends. Of late, it has been expanding its software offerings with the acquisition of NGINX, using cash on hand. Donovan Jones wrote a good explanation of the deal on Seeking Alpha here. Software revenues were up +91% year-over-year in the latest quarter, largely from NGINX products.

2019 Stock Decline

NGINX related purchase costs and integration effects have slowed earnings growth during 2019. Overall, this past year has not been a stellar one for core revenue improvement at F5, and Wall Street has reacted. On the charts below, I am comparing F5’s performance to peers and