The Chinese government launched a series of financial regulations since 2017 to better monitor the third-party online payment industry. The raising of escrow accounts' reserve ratio may have created a significant impact on payment companies' revenues and profits.

Tencent Holdings Ltd. (OTCPK:TCEHY) flagged the regulatory impacts on its payment revenues several times on conference calls in the past quarters. Before 2018, the reserve ratio of payment escrow accounts was only around 20%. It means that payment companies can cultivate revenues from the deposit balance (80%) which is not in the central banks. The interest contributed considerable revenues to top-ranking payment companies.

However, the company's fintech business is still classified under its other revenue line, together with cloud and other enterprise services. In terms of financial reporting, TCEHY never gives a breakdown of its revenue or margin profiles like in the case of splitting between online payments versus financial services.

Hence, Wall Street analysts are groping for answers on how to visualize an integrated model of its fintech business, as it does with its other individual core segments such as gaming and online advertising. So, I might as well shed light on analysts and investors regarding the enterprise value of TCEHY's fintech business per se, with a particular focus on the framework of its payments segment.

TenPay: 40% of Total TPV

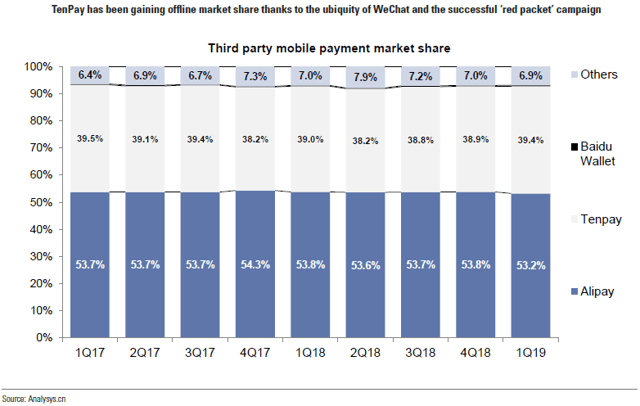

Based on Analysys' estimate, China's payments market is a duopoly. TCEHY's TenPay and Alipay (BABA) dominated the market with 40% and 55% of total payment volume (TPV), respectively. TCEHY's payment services have accumulated greater than 800 million active users, ranking as the number one payment platform in China. The company is leveraging the overwhelming market-leading position of its Weixin and QQ in China's social network and online consumption space.

Further to TenPay, TCEHY also offers other high-margin financial services to its