Fundamentally, Biolife Solutions Inc. (NASDAQ:BLFS) is stronger than ever: year-to-year revenue growth of +29%, Gross Margins of 72%, successful recent acquisition of two tissue storage/transport companies that will add to the top and bottom lines, an ever-increasing list of customers, and positive net income - a feat difficult to achieve for most rapidly growing biotechs.

And yet, the strengthening fundamental position has resulted in seven months of choppy sideways price action, trying the patience of all Biolife Solutions investors, myself included. So what gives?

Investment Thesis: The sideways price action is not indicative of fundamental problems for Biolife Solutions. On the contrary, the fundamental picture shows a young company in a young industry positioned for explosive growth; and when viewed from a multi-year perspective, the technical price chart shows a healthy uptrend that is merely digesting some phenomenal gains.

Biolife Solutions provides biopreservation media, intelligently monitored transport products, and automated thawing systems. Source: biolifesolutions.com

Impressive Revenue Gains

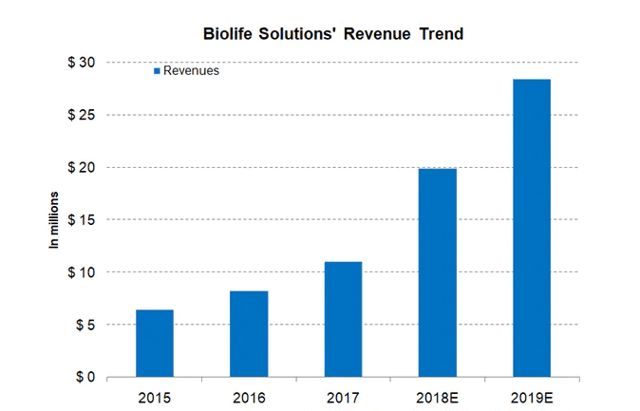

Quarterly revenue of tiny biotechs (Biolife Solutions has a marketcap of $360 million) is by nature sporadic and seasonally affected; and therefore, revenue is best viewed from a year-to-year basis. A quick glance at Biolife Solutions multi-year revenue growth is highly encouraging; we see strong steady growth:

Source: marketrealist.com

A Customer Base in its Infancy

But, what is most exciting is not the impressive revenue trend of the past, but the promise of explosive revenue growth in the future. CEO Mike Rice explained in the August 8, 2019 Q2 earnings call that nearly all of the company's revenue comes from customers whose products are not FDA approved, but rather still in clinical trials. "The big step changes in revenue," he said, "are still out in the next three to five years."

Biolife's many customers ("Products embedded in nearly 400 customer applications.") are themselves