Hanmi Financial Corporation's (NASDAQ:HAFC) provisions charge for loan losses is expected to return to normal in 2020, which will increase earnings next year compared to 2019. Other earnings components are expected to see flat growth year over year.

Provisions To Continue To Remain Low

HAFC's earnings received a hit in the second quarter from a $15.7 million allowance relating to a troubled $40 million loan relationship. The provisions charge returned to normal in the third quarter, showing that the spike in the second quarter was in fact non-recurring. Going forward, provisions charge for credit losses is expected to remain low because the spike was apparently a standalone event only and not a widespread problem.

The implementation of the new accounting standard for credit losses named the Current Expected Credit Losses, CECL, standard may increase the allowance balance for loan losses, which will negatively affect equity. Post the implementation of the standard, there is risk that higher provisions charge will become the new normal. For now, I am not assuming CECL to drive a significant rise in provisions charge, but I may have to revise my assumptions in the future as more details come to light.

Selective Disbursement To Result In Modest Loan Growth

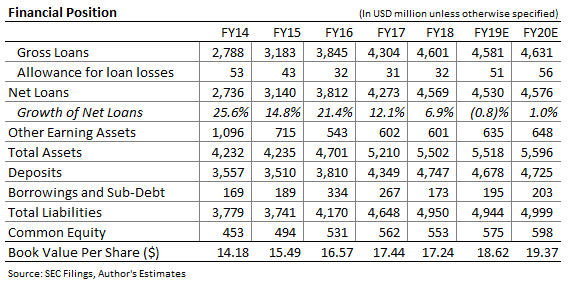

As mentioned in the 3QFY19 conference call, HAFC's strategy is to protect net interest margin with a moderate growth in loans and leases. The management also mentioned that the Asian-American landscape HAFC operates in is currently very competitive. Due to HAFC's preference to maintain margins and not aggressively price its credit products, I'm expecting the company to experience only moderate loan growth in 2020. The table below shows my loan estimate of $4.5 billion, depicting 1% year-over-year growth.

Limited Downside Foreseen For Margins

Due to HAFC's focus on margin maintenance, it is likely that monetary easing will have