Management must be willing to submit itself to the disciplines required for sound growth. - Phillip Fisher

In the thick of concerns relating to drug pricing control and China Trade War, Clovis Oncology (CLVS) shares have receded significantly below its true worth (i.e. intrinsic value). In my view, the "down market" decimated Clovis' share price rather than any fundamental weakness. In other words, most bioscience stocks have been hit hard despite their sound underlying fundamentals. That aside, I believe that the market's extreme negative sentiment on Clovis' high cash burn rate contributed to the decline. As such, I'll revisit this company and provide you with an update on its underlying fundamentals.

Figure 1: Clovis Oncology chart (Source: StockCharts)

Figure 1: Clovis Oncology chart (Source: StockCharts)

About The Company

As usual, I'll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Headquartered in Boulder Colorado, Clovis Oncology is engaged in the innovation and commercialization of medicines to serve the unmet needs in various conditions, including ovarian, prostate, breast, and bladder cancers.

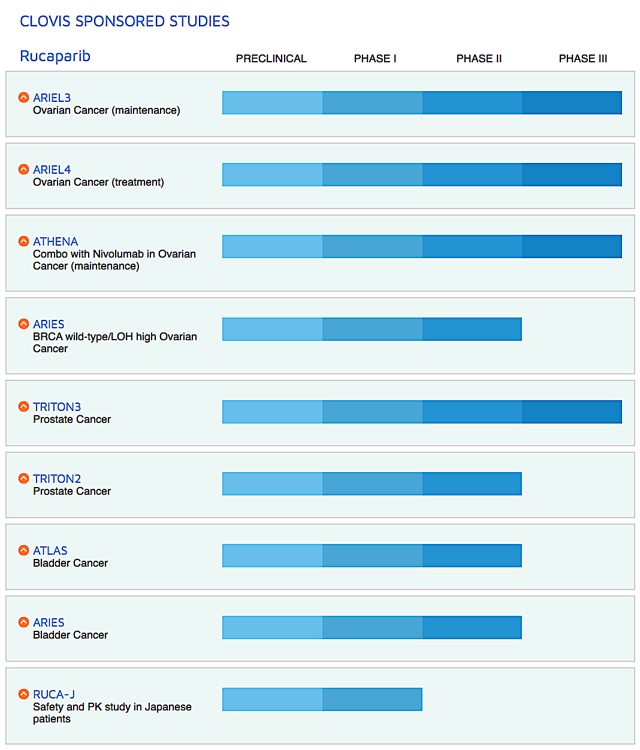

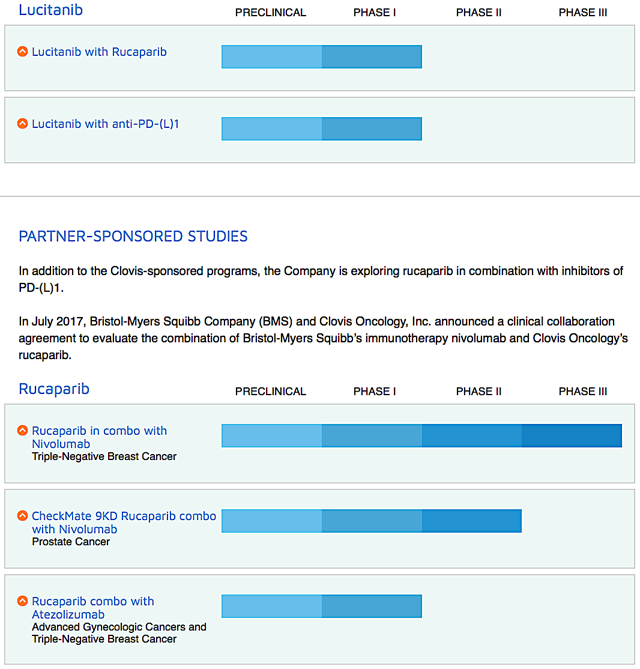

Back in April 2018, the FDA granted marketing authorization for Clovis' lead molecule, rucaparib (Rubraca) - an oral, small-molecule inhibitor of poly (ADP-ribose) polymerase ("PARP") 1, 2, and 3 - as second-line maintenance for recurrent ovarian cancer. Though commercialized, Rubraca's sales have been gradual because a second-line drug is unlikely to garner blockbuster results. Asides from the commercialized asset, Clovis is investigating various combination treatment of Rubraca either with immune checkpoint inhibitors and other drugs (lucitanib and rociletinib) for different cancers as depicted below.

Figure 2: Therapeutic pipeline (Source: Clovis)

Blockbuster Franchise

Powered by a vast pipeline, the clinical risks are significantly lowered because of Rubraca's approval. In other words, Rubraca's commercialization for ovarian cancer is a validation of the drug's excellent efficacy and safety

Thanks for reading! Please hit the orange "Follow" button on top for updates.

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable, and very honest… I would highly recommend this service, and his stock picks have been very profitable.

Simply put, this is worth every penny. Just earlier today, one of the companies recommended by Dr. Tran got acquired for a nice 50% premium.

As I reserve higher market intelligence and exclusive features for IBI members, I invite you to take my temporary offer of 2 weeks FREE TRIAL.