ETF Overview

Fidelity MSCI Healthcare Index ETF (NYSEARCA:FHLC) owns a portfolio of large-cap healthcare stocks. The ETF tracks the performance of the MSCI USA IMI Health Care Index. Stocks in FHLC’s portfolio should benefit from aging demographic trends in the U.S. and the rest of the world. The ETF is a nice defensive choice as demands for treatment and healthcare services do not diminish even in an economic recession. FHLC is currently trading at a valuation below its historical average. We believe it is a good fund to own, especially for investors with a long-term investment horizon.

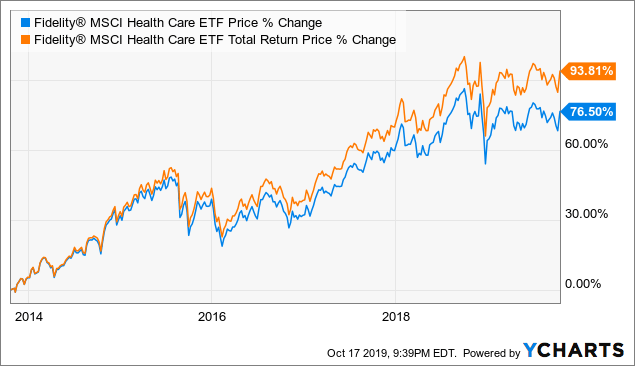

Data by YCharts

Data by YCharts

Fund Analysis

The fund should benefit from an ageing population

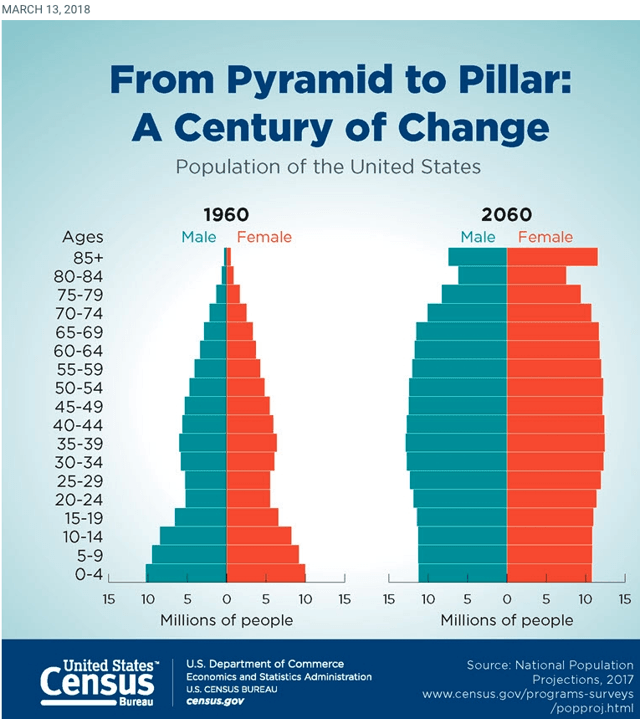

Stocks in FHLC’s portfolio should benefit from an ageing population in the United States and the rest of the world. According to U.S. Census Bureau, the number of Americans ages 65 and older is projected to more than double from 46 million today to over 98 million by 2060. The 65 and older age group’s share of the total population will increase to nearly 24% from 15% today.

Source: United States Census Bureau

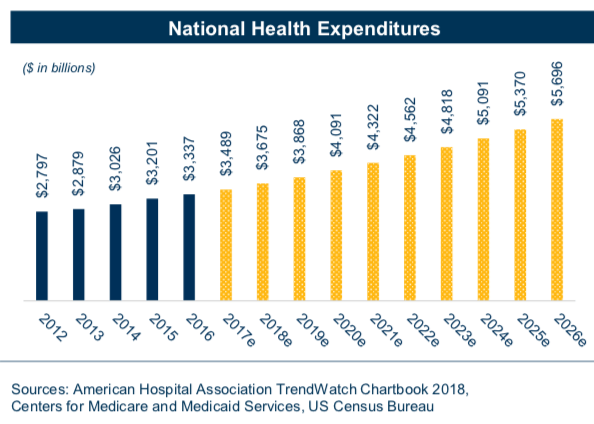

As we know, people who are older will spend more on health services than those who are younger. As can be seen from the chart below, national health expenditures are expected to grow significantly from $3.7 trillion in 2018 to $5.7 trillion in 2026. This long-term strong demand will act as a tailwind to the healthcare industry. Therefore, we believe stocks in FHLC’s portfolio will benefit from strong demand for healthcare services in the U.S.

Source: Physicians Realty Trust Investor Presentation

Besides an aging population in the U.S. the world’s population is also aging. According to a report by the United Nations, the number of people aged 60 years or older will double by 2050 from the current level today (see