Source: Tiny Buddha

Source: Tiny Buddha

Okta (NASDAQ:OKTA) is a solid stock with strong growth. Management has executed well in recent quarters, and there are ample catalysts to propel the stock in the long term. However, recent macro developments have made the stock more sensitive to another correction. Given the earnings performance of most SaaS stocks, it's safe to conclude that the market is expecting nothing less than a beat and guidance raise for a SaaS stock to preserve or enjoy multiple expansion. Anything short of that and the stock gets punished. That's how brutal it has gotten.

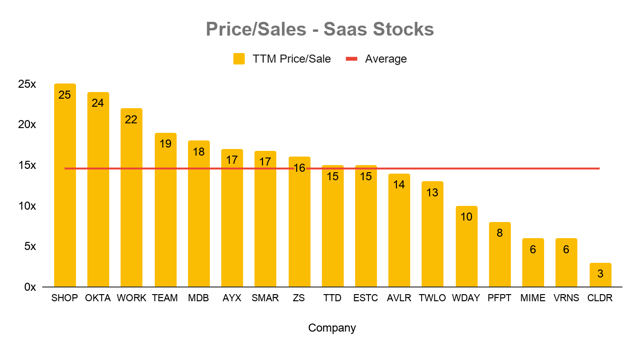

Source: Author (using data from Seeking Alpha)

The P/S graph above details the ranking and median TTM P/S ratio of 17 SaaS stocks. Nearly all of them are unprofitable. Okta has the second-highest TTM P/S ratio in this ranking. From a peer-average valuation, it's safe to assume Okta is overvalued. However, the P/S ratio is a function of future revenue growth. The P/S ratio is easily diluted if the forward revenue growth rate is high. For example, given that the P/S ratio has a direct correlation with the market cap, a 100% forward revenue growth has a 100% dilution impact on the price to sales ratio. A company with a P/S ratio of 10x projected to grow at 100% will have a forward P/S of 5x. Therefore, we can't say such a company is overvalued, given its huge growth rate.

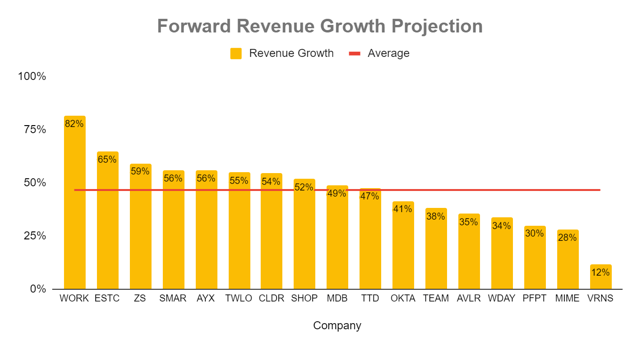

Source: Author (using data from Seeking Alpha)

To quickly identify stocks trading at a premium to their forward revenue growth estimate, we only need to find stocks below the red line on the forward revenue growth chart and check to see if their P/S ratio is above the red line in the TTM P/S chart.

Okta and Atlassian (TEAM) are the only stocks that