Don't be afraid of buying on a war scare. - Phillip Fisher

One of the most opportunistic time to invest in a stock is when it's "beaten down but not out." When I say "not out," I mean that despite all the market negativity, the company is still undergoing strong fundamental advancement. I believe that when you invest in a company at that point in its life cycle, nearly all the risks are deleveraged. Warren Buffett's teacher (Benjamin Graham) would have called this type of investment as having a "wide margin of safety" because Graham correlates safety with the stock price.

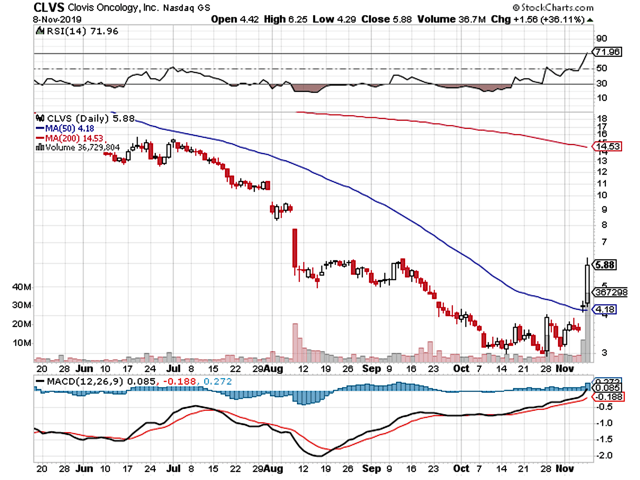

That being said, a stock that exemplifies the aforesaid phenomenon is Clovis Oncology (CLVS). In the previous article, I mentioned that the combination of the China trade war and drug pricing concerns nearly decimated the company's share price. Nonetheless, I believe that these difficulties are temporary. There are unfolding fundamental developments that will buckle the pessimistic market trend. In this research, I'll present an update to the investment story on Clovis as reflected in the latest earnings report.

Figure 1: Clovis Oncology chart (Source: StockCharts)

About The Company

As usual, I'll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Operating out of Boulder, Colorado, Clovis Oncology is focused on the innovation and commercialization of medicines to serve the unmet needs in various conditions, including ovarian, prostate, breast, and bladder cancers. I noted in the prior article:

Back in April 2018, the FDA granted marketing authorization for Clovis' lead molecule, rucaparib (Rubraca) - an oral, small-molecule inhibitor of poly (ADP-ribose) polymerase (“PARP”) 1, 2, and 3 - as second-line maintenance for recurrent ovarian cancer. Though commercialized, Rubraca's sales have been gradual because a second-line drug is unlikely to garner blockbuster results. Asides from the commercialized asset, Clovis is investigating various combination treatment of

Thanks for reading! Please hit the orange “Follow” button on top for more. And don’t miss out on the most profitable content (higher level intelligence) inside IBI. Here’s what members are saying:

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable and very honest … I would highly recommend this service and his stock picks have been very profitable.

Simply put, this is worth every penny. Just earlier today, one of the companies recommended by Dr. Tran got acquired for a nice 50% premium.

Take your 2-weeks FREE trial now!