Image: EOG rig from EOG Resources

Investment Thesis

The Houston-based EOG Resources (NYSE:EOG) is one of the top-tier US shale players that I regularly cover on Seeking Alpha.

I like EOG because of its pragmatic management that has followed a rigorous strategy over the years that resulted in steady growth.

EOG Resources presents a rock-solid balance sheet with substantial growth potential. It makes the stock an excellent long-term candidate, especially after nearly a 20% drop since January, despite what I consider stellar results realized in a weak oil and gas price environment.

However, this oil company is another perfect example of my basic strategy attached to the entire oil sector. The investment thesis is quite simple.

First, you identify a reliable company with a solid track record producing excellent cash flow, where you are confident to invest and accumulate for the long term. A company with a good dividend yield is even better. EOG Resources is paying a low dividend yield of 1.56%, which is quite harmful.

Second, you have to be willing to trade about 30% of your position by using short-term volatility. It is an essential part of the strategy and will provide you with better control of your investment.

This successful US Shale producer can be compared with Occidental Petroleum (OXY), which is also involved with the US Shale almost exclusively and is the leader in the Permian Basin. The stock has underperformed EOG since the start of 2019.

The chart below is showing a 22% differential, mostly attributable to the ill-timed Anadarko acquisition.

What makes EOG a good business?

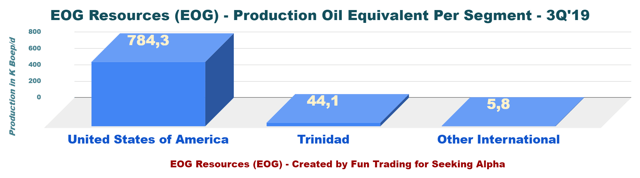

The company is primarily producing oil and gas from the US Shale or 94% of the total output in 3Q '19.

| Production per Region in K Boe/d | 4Q'17 | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 | 3Q'19 |

| United |