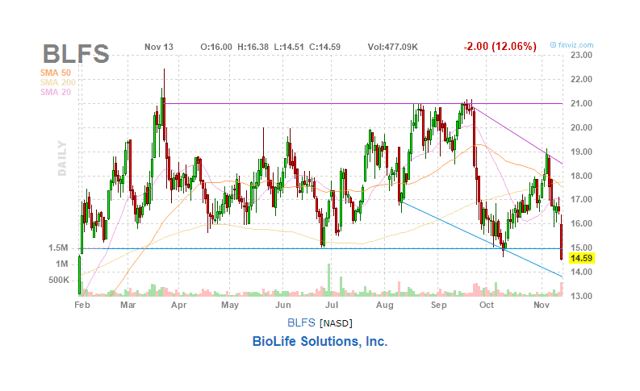

We hold shares of BioLife Solutions (NASDAQ:BLFS) in the SHU portfolio and are still sitting on considerable profits, but the shares have retreated quite a bit lately.

We can sort of live with the market reaction to BioLife's third-quarter figures, which were indeed disappointing. The company's organic growth in preservation media was just 15% in Q3, and quite frankly, we cannot remember a quarter with such little growth.

In part this was due to two one-off events, with important customers shaving off nearly $1 million from Q3 revenues (the two customers have resumed normal order patterning in Q4). But even if this had not happened, organic growth would have been just 25%, at the low end of expectations and too low for the share price not to be affected given the high valuation multiples (see below).

Another way of looking at the company

But there is another way of looking at this. In Q3, BioLife also raked in 62 new customers, 41 of which are new cell and gene therapy customers, and the company processed another 18 new FDA master file cross-reference requests supporting customer use of its preservation media in pending human clinical trials.

Every quarter, the company increases its customer lists by the dozen, and this is now totaling over 400 customers. That is, every quarter the universe from which customers emerge to bigger tests and eventually get FDA approval and go commercial gets bigger and bigger.

And it's in going commercial where the real money is for BioLife, as that usually brings an order of magnitude or more in scale compared to clinical trials.

Revenue growth in Q3 (which isn't yet included in the figure) was 25%, so it's back to historical trends. The growth spurt in 2018 was on the basis of a customer going commercial, YESCARTA from Gilead (