(Image source: Investor presentation)

Well, that was ugly. I’ve been bullish on work wear retailer Duluth Holdings (NASDAQ:DLTH) in the past, as I’ve been attracted to the company’s long runway for growth, but as you can see from the chart below, that hasn’t exactly worked out in 2019. Shares began the year near $24 and trade for just $9 today. If you’ve owned Duluth this year, it has no doubt been painful. However, the good news is that if you haven’t, it looks like Duluth could be worth a look at this low level.

Why Duluth?

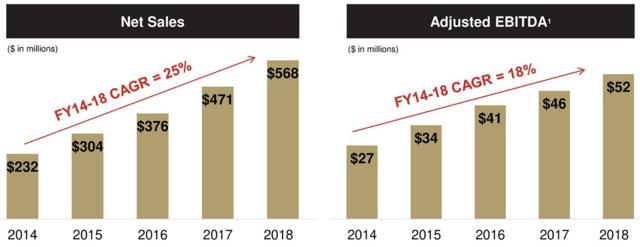

I mentioned I’ve been bullish on Duluth before, but why? In short, the company offers a differentiated mix of high-end work wear that is positioned as the most durable and comfortable lineup available. To that end, Duluth’s clothing isn’t cheap, but it isn't trying to be everything to everyone. Duluth is betting that people that need durable clothing for their jobs and/or their leisure time - like farmers, construction workers, etc. - will pay more for comfort and durability. In addition, it has bet heavily on the women's category in recent quarters, which has produced strong growth. Up until this year, I’d say that has worked. Indeed, if we look below, we can see the immense growth the company has posted historically.

(Source: Investor presentation)

Sales growth of 25% is very difficult to come by in any industry, but in particular, for a retailer. Duluth had almost no stores a few years ago, but has made a concerted effort recently to introduce stores to new markets. The company has made it work, but it hasn’t translated to earnings growth in the same way due to the typical growing pains associated with a rapidly growing retailer.

SG&A costs have risen, as you’d expect, given that scaling a