Spirit Airlines Inc. (NYSE:SAVE) calls itself an "ultra-low cost carrier" with over 600 flights per day to 75 destinations primarily in the United States with operations in the Caribbean and Latin America. The company's strategy has been to compete on pricing supported by a high aircraft utilization and high seat density layout in an otherwise no-frills passenger flying experience. The stock has been under pressure, down by nearly 35% this year based on some weaker margin and softer operating metrics including a slight decline in passenger yields although the outlook remains positive. We think the current share price weakness represents a buying opportunity as growth appears stable and the company remains profitable with positive free cash flow. This article recaps recent developments and our view on where SAVE is headed next.

Source: Finviz.com

Q3 Earnings Recap

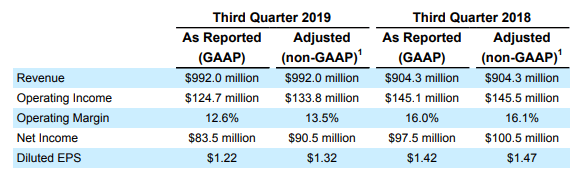

SAVE reported its fiscal Q3 earnings on October 23rd with non-GAAP EPS of $1.32 which was $0.09 ahead of expectations. Revenue of $992 million on the quarter represented an increase of 9.7% compared to last year and was also ahead of estimates.

Source: Company IR

The story this quarter was record passenger volumes while some operational challenges including the negative impact of storms marked a somewhat mixed result. The market focused on the operating margin of 13.5% which was below the trend of the trailing twelve months at 14.2% with the company noting total revenue per available seat mile declined by 1.7% y/y even as capacity increased by 11.6%. Hurricane Dorian is estimated to have impacted revenues by $20 million.

Favorably, per-passenger non-ticket revenue increased by 1.7% y/y to $55.37 representing progress in growth initiatives by the company. Higher non-ticket revenue recovery is a growth driver for the company which will be in combination with increasing capacity going forward. Programs like an expanded loyalty program and revamped website with