Jefferies' Sale Of Its National Beef Stake Could Lead To A Huge Buyback

On November 17, 2019, Jefferies Financial Group (NYSE:JEF) made a surprise announcement. Jefferies reported that its remaining stake in National Beef, a long-held private company investment, had been sold for $970 million.

Even more amazing, the announcement said that the sale would close on or before November 30, 2019. This is the last day of Jefferies' fourth quarter for the 2019 fiscal year. This immediately led to speculation that the company would do a large share buyback. KBW analyst was quoted by Seeking Alpha as saying that a share repurchase of up to 20% of the stock could be bought back in 2020.

I decided to look into this possibility further. I have written several articles about Jefferies in the past six months. I am intrigued by Jefferies' stock since it sells below book value, including tangible book value, pays a healthy dividend, including a recent special dividend, and the company has been buying back shares.

Jefferies' Stock Sells Below Book Value And Tangible Book Value

At $19.83, JEF stock trades significantly below its book value per share ("BVPS") and tangible book value per share ("TBVPS'). For example, at $33.42, BVPS is 68% higher than JEF stock and at $25.30, TBVPS is 27.5% higher than today's price:

Source: Hake estimates

Jefferies' Buyback Program

If you are going to repurchase shares, it is best to do it when your stock is selling at a cheap price, preferably below tangible book value. So this would be very astute of Jefferies' management if they were to buy back a lot of shares.

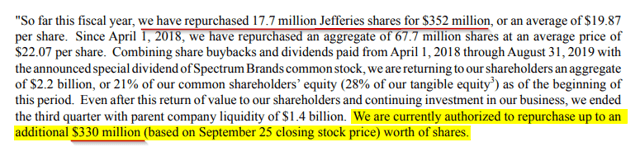

It turns out that in the Q3 earnings announcement, JEF management indicated that it had $330 million of shares left under its present buyback program:

Source: Jefferies Q3

Total Yield Value Guide

Extensive financial analysis of high total yield and deep value stocks

The Total Yield Value Guide follows high dividend yield, and high buyback stocks (total yield) and stocks with abundant net cash, cash flow, and catalysts. Our focus on high buyback yield stocks (buybacks/market price) plus high dividend yield is unique. These stocks tend to perform well over time.

Subscribers receive exclusive articles, model spreadsheets on stocks published both here and on other sites, access to my historical articles and a chat room.

Subscribers also receive a free two-week trial to review the service.

Here is the link to subscribe.