This article was co-produced by Dividend Sensei and edited by Brad Thomas.

Value investors have had a rough time over the past decade, suffering the worst period of underperformance vs. growth stocks since the Great Depression.

The current value-growth cycle has been particularly daunting for anyone with a value orientation. Value has been out of favor for approximately 12 years at this point. In this prolonged phase of growth dominance...

Historically, value stocks around the globe tend to win more often than they lose, beating growth over five-year rolling intervals approximately 55% of the time for the full period of our analysis, rising to 70% over rolling 10-year intervals.

That's not reliable enough for most investors, but the starting points for winning spans and losing spans are very different, and the most recent decade is one of the worst of these spans." - Research Affiliates

Of course the core requirement of anyone attempting to, in the words of legendary investor Joel Greenblatt (40% CAGR total returns for 21 years) "buy above-average quality at below-average prices" is patience and a capacity to suffer through long stretches of underperformance.

"It's easy to stand with the crowd. It takes courage to stand alone." - Mahatma Gandhi

Value investing (which is really just sound investing principles that aim to buy growth at a reasonable price) doesn't have to mean your stocks are falling.

Consider Super SWAN dividend king REIT Federal Realty Trust (NYSE:FRT).

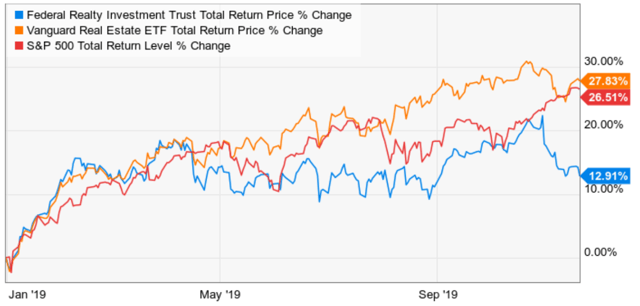

(Source: YCharts)

FRT started off the year strong but has spent most of the year underperforming REITs and the S&P 500. Now, recession risks are rising again (trade deal uncertainty) and are up from 24% to 30% in the past two weeks. That's over concerns that US/China trade talks might stall.

The media's frenzy over the "retail apocalypse" is heating up yet

Managing Risk Is What We Do Best

iREIT on Alpha is one of the fastest-growing marketplace services with a team of five of the most experienced REIT analysts. We offer unparalleled services including five customized portfolios that are doing extremely well in the moment - but are built to stand the test of time too. Sign-up for the 2-week free trial today!

Subscribers to iREIT on Alpha will get access to RINO and over 125 REITs screened by QUALITY and VALUE. Our research is powered by qualitative data analysis that provides a decisive edge to achieve superior portfolio results.