FET Looks To Improve Margin

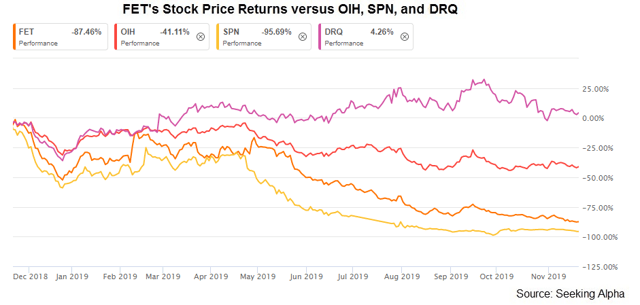

Forum Energy Technologies (NYSE:FET) serves the drilling, subsea, completions, production, and infrastructure business in the energy sector. I expect the stock price to remain depressed in the short term. Its margin can improve due to an improved product mix and various cost reduction initiatives. I think it needs to improve cash flows and reduce the financial risks before investors can expect steady returns in the medium-to-long term.

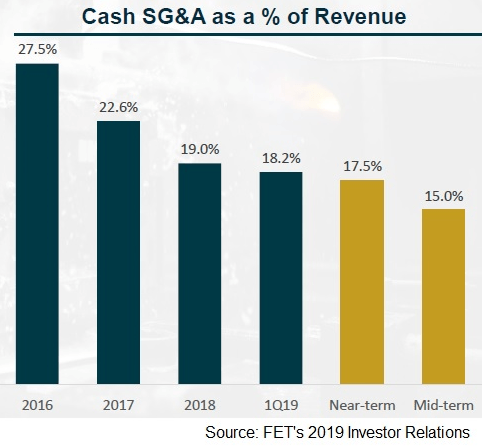

Following the reduction in the upstream capex, the demand from capital equipment can continue to decelerate in the U.S. onshore. The company’s falling order in the Production segment is an indication of the challenging times. To counter this, the company will continue to increase its share of revenues from international operations. The company’s artificial lift and drilling & downhole products can stimulate growth in the international market. FET had been reducing its SG&A costs and inventory to streamline working capital management.

Strategy Changes: International Markets And Cost Minimization

Let us try to understand what FET is doing to counter the completion market slowdown in the U.S. In recent times, Saudi Aramco (ARMCO) (one of the largest integrated oil companies) approved the company’s downhole product - the packer stage collar product. Apart from that, the company has identified opportunities to increase sales in onshore gas injection lines and offshore tiebacks. The company’s management reckons that the demand for coiled tubing product - DURACOIL (coiled tubing string), and pipe handling equipment for drilling rigs will keep increasing as a result of higher onshore activity in the region. In the North Sea, too, the company will look to gain market share offshore coiled line pipe by the end of 2019.

The company also aims to increase EBITDA on a year-over-year basis. To this extent, it has undertaken various cost reduction measures. To reduce overhead

We hope you have enjoyed this Free article from the Daily Drilling Report Marketplace service. If you have been thinking about subscribing after reading past articles, it may be time for you to act. The oilfield is at its low ebb, and now is the time to be looking for winners.

Good news for new subscribers! In November, we are offering a 10% discount off the annual subscription rate of $595.00.

A 2-week free trial is applicable, so you risk nothing. Hope to see you in the DDR as we look for bargains in the oil patch!