A few days ago, I wrote an article on Federal Realty (FRT), a stalwart "Dividend King" with a record of paying and increasing dividends for over 50 years in a row. Believe me, it's no fluke that this REIT has delivered such an extraordinary record of performance by increasing dividends through multiple economic cycles.

We maintain a buy on Federal Realty, recognizing that shares are "currently about 7% undervalued for 2019" with one of "the best management teams in the industry." The dividend yield is 3.2%, albeit low for an income investor, but reasonably attractive for a value investor.

Today I want to provide readers with another alternative, that also has an enviable dividend-paying track record, with a current dividend yield of 4.70%. As Ralph Block wrote in the book, Investing in REITs,

"What makes REIT shares so attractive compared with other high yield investments like bonds and utilities is their significant capital appreciation potential and steadily increasing dividends."

And he went on to explain that "long-term investors should be looking at REITs with dividends that are not just safe but also have good growth prospects."

The Basics

Urstadt Biddle (UBA) (UBP) was founded in 1969 and listed shares on the New York Stock Exchange on July 6, 1969. The Greenwich-based company is a shopping center landlord owning a portfolio that includes 85 properties totaling 5.3 million square feet. Most of the properties are grocery-anchored and located in the high-density New York tri-state region.

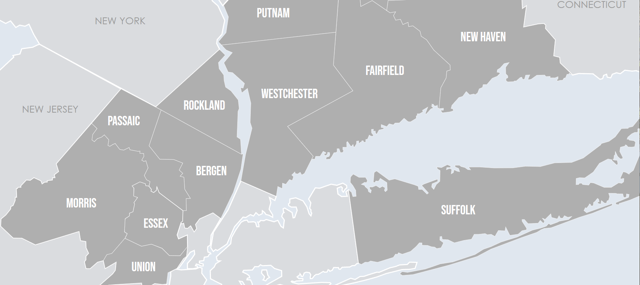

Source: UBA website

UBA invests in one of the strongest demographic profiles among public shopping center REITs. The company's core portfolio is primarily centered in densely populated high-income regions of Fairfield County, CT, Westchester, Putnam, and Rockland counties, NY, and Bergen County, NJ.

These markets are considered high-barrier-to-entry due to the high land, entitlement and

Managing Risk Is What We Do Best

iREIT on Alpha is one of the fastest-growing marketplace services with a team of five of the most experienced REIT analysts. We offer unparalleled services including five customized portfolios that are doing extremely well in the moment - but are built to stand the test of time too. Sign-up for the 2-week free trial today!

Subscribers to iREIT on Alpha will get access to RINO and over 125 REITs screened by QUALITY and VALUE. Our research is powered by qualitative data analysis that provides a decisive edge to achieve superior portfolio results.