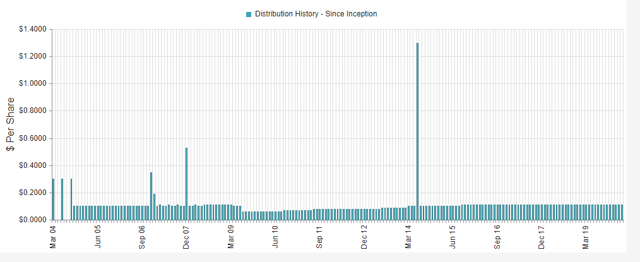

Gabelli Dividend & Income Trust (NYSE:GDV) has been a steady performer and reliable dividend payer since it launched in 2004. Its only major dividend reduction was during the financial crisis. GDV pays monthly dividends, and currently yields approximately 6.3% much higher than approximately 1.9% for the S&P. Most other funds that yield >5% use much more exotic strategies involving high yield debt or real estate, but GDV uses a classic value investing style focusing on large cap equities.

Portfolio

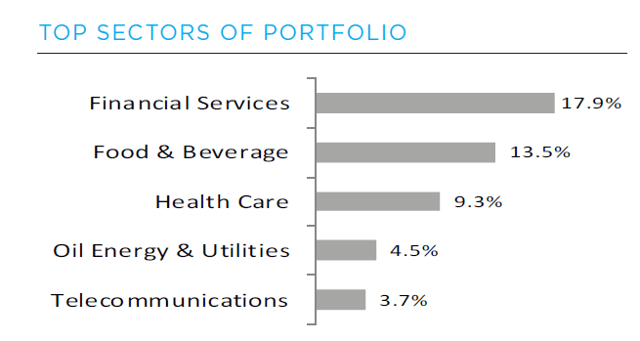

GDV generally buys large cap stocks with a strong dividend history that are slightly out of favor. They have large exposure to the financial services industry, as a lot of old school value investors typically do at this part of the cycle. For example, their largest positions include American Express (AXP), Bank of New York Mellon (BK), and JP Morgan Chase (JPM). In the food and beverage sector some of their largest holdings include Mondelez (MDLZ) and Pepsi (PEP). Although most of the largest holdings are in the US, around 20% of the portfolio is international, In the most recent quarterly letter they mentioned positive earnings trends that aren’t fully recognized by the market in many o f its key holdings.

GDV has approximately $2.5 billion in assets. The following table shows GDV’s portfolio by sector.

Unique Capital Structure

GDV has issued multiple classes of preferred stock and Auction Rate securities. GDV will likely repurchase some of the 6.0% Series D GDV.PD , Preferred Stock using some of the proceeds from a recent rights offering., leaving the lower cost preferred shares outstanding. The auction rate securities are likely to remain outstanding for many more years due to the drying up of that market post financial crisis. GDV’s common equity/assets ratio is 80%, and the preferred dividends are well covered by investment