Furniture and home goods disruptor RH (NYSE:RH) continues to absolutely fly higher. The stock was cut in half, more or less, earlier this year, but has since risen a staggering 144% just since the June bottom. RH shareholders are certainly no stranger to volatility, as this stock has made enormous moves in both directions for years. Despite this move, I think RH still has room to run for the long-term given the outstanding performances the company continues to turn in.

RH is still producing for shareholders

RH's story has been an interesting one to watch develop over the years, but the bottom line is that the company remade itself in recent years to a subscription-based, ultra-luxury home goods and furniture destination. In addition, some of its larger galleries have restaurants to help drive traffic to the store that otherwise wouldn't be there. This is one of the key differentiators for RH, and why it believes it is disrupting physical retail. I tend to agree, and I've been very supportive of RH here on Seeking Alpha over the years, in part, for this very reason.

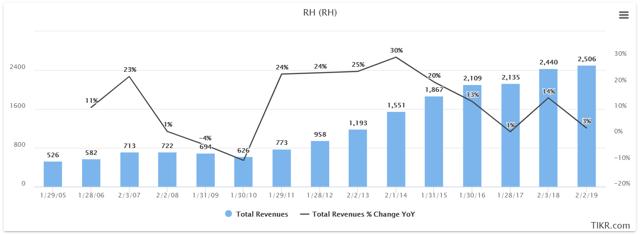

But the company's strategy isn't just a lofty, idyllic goal; it is translating into real money and real growth. Below, we can see RH's revenue growth from the past several years that has been afforded to the company because of its strategic moves, and indeed, the success of those moves.

Source: TIKR.com

Revenue was just over $500 million in 2005, cresting at $722 million in fiscal 2008, just before the financial crisis sent RH's revenue growth rate below zero for two years. However, since then, it has been growth on top of more growth, with some truly eye-popping numbers in some of the years. In fact, there were five consecutive years following the financial crisis with at least 20% annual revenue growth, which is truly outstanding. More