After surging more than 90% since last December, Ball Corp. (BLL) is now trading at a near-20% discount to those highs set toward the end of August and early September. Valuation multiples are still well above the sector median, but there are signs that the company's struggle for revenue growth won't last beyond the short to medium term. Looking at historical P/E values, after briefly breaching 32, forward P/E now stands at a more reasonable 26 or so. If internal efforts and macro trends are anything to go by, then Ball Corp. is looking at fairly strong long-term growth that will eventually justify buying at the current price.

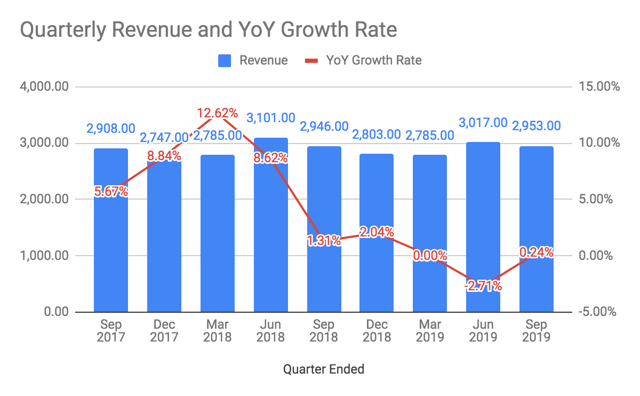

First, let's look at the company's revenue growth figures for the quarters after the Rexam acquisition lapped a year in July 2017.

(Source: Data from SA Premium)

The company, at the Q3 earnings call on October 31, 2019, said that much of its growth for the first three quarters of FY 2019 was impeded by "tight inventory levels, tight capacity conditions and some manufacturing inefficiencies."

BLL is actively addressing this issue by expanding capacity across its core North American market with the intention of increasing its unit output by 5 billion over the next year to eighteen months. Ball Corp. announced a new facility to exclusively manufacture its recently - and successfully - launched "infinitely recyclable" aluminium cup offering. The expected timeline for that is 12-15 months, which means we should see results during Q3 or Q4 2020. In addition, a new beverage can facility has been planned, primarily to help match the additional can-filling capacity of one of its big-ticket clients.

The company has also been busy cutting off the non-starters in its line-up. The two divestitures that were highlighted in the earnings release were the Chinese beverage can business and the