Investment Thesis

Until more convincing cold starts showing up in the models, downside risk will outweigh upside potential.

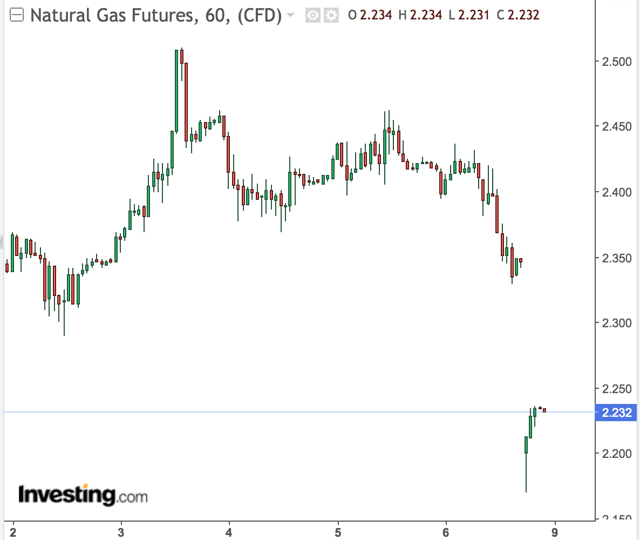

On Friday, the front-month January contract settled down 9.3 cents ($0.093) to $2.334/MMBtu, the February contract settled down 7.9 cents ($0.079) to $2.319/MMBtu, and the March contract settled down 6.3 cents ($0.063) to $2.249/MMBtu. Figure 1 below is a chart depicting the price trend of the front-month January contract over the past week.

On Friday, the United States Natural Gas ETF (UNG), which is the unleveraged 1x ETF that tracks the price of natural gas, finished down 2.65% to $18.03.

UNG's leveraged exposure ETFs, the VelocityShares 3x Long Natural Gas ETN (UGAZ) and the ProShares Ultra Bloomberg Natural Gas ETF (BOIL), were seen lower by 8.59% and 5.63% at $9.36 and $9.56, respectively. Meanwhile, UNG's high-beta leveraged inverse ETFs, the VelocityShares 3x Inverse Natural Gas ETN (DGAZ) and the ProShares UltraShort Bloomberg Natural Gas ETF (KOLD), were seen higher by 8.07% and 5.51% at $155.79 and $34.86, respectively.

Weather pattern decidedly milder over the next couple of weeks; variable over the next 10 days before a cool West U.S. vs. mild Central and East U.S. sets up in the 10-16 day

The weather pattern will remain quite progressive/variable, but mild overall sprinkled with punctuated periods of cold shots here and there over the next 10 days or so.

This progressive yet mild state that we'll be in over the next 10 days or so will feature an active jet stream that will mostly be in a zonal to semi-zonal configuration and at times becoming more amplified that will support the periods of cold air intrusions.

The first cold shot will take place this week (approx. Tues.-Thurs.) amid an upper level vortex/cyclonic flow that's rotating over the Hudson/James Bay in central Canada. Forecast guidance over