I'm starting a new series on long-term investments. The criteria for companies to be evaluated is those that are well-established, large and proven businesses, with long-term stable earnings. These are the types of companies that are great for 5 - 10 year holds. This series would evaluate these kinds of companies on a qualitative and quantitative basis. The qualitative criteria involve examining their long-term sustainable competitive advantage, and growth/innovation. On the quantitative side, I will be using a traditional discounted cash flow model to estimate the value of the firm. The discounted cash flow model works best for companies with established business models that are growing at a stable rate. In this article, I will examine Dunkin' Brands Group (DNKN).

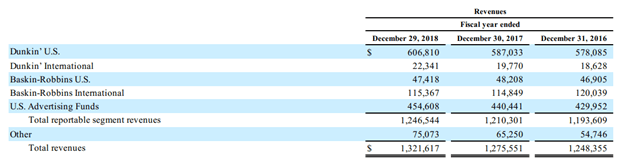

Just a quick background for readers who don't live in the US. Dunkin' is one of the world's leading franchisors of restaurants serving coffee and baked goods, as well as ice cream, within a quick-service restaurant. The company franchises its "Dunkin" restaurant concept and licenses its brand for K-Cups and ready to drink coffee. The company's other main brand is Baskin-Robbins which focuses on ice cream sold in the company's restaurants or other retail outlets. Although present in multiple countries, the company's US sales makes up 80% of its total revenue with Dunkin' accounting for the lion's share.

Source: Company 10-K

Sustainable Competitive Advantage

The quick-serve restaurant industry is highly competitive and restaurants continuously fight for survival and some of them are facing even the worst scenario due to the cut-throat competition. The keys to success in this industry are: 1) Scale; 2) Operational Efficiency; and 3) Brand loyalty. Being one of the largest and oldest restaurants in the US, Dunkin' definitely has the scale and operational efficiency to compete with the best. The company has around 9500 locations in the US which is less than Starbucks' (