Source: Investor presentation

Wholesale club BJ's (NYSE:BJ) has had a bumpy road since coming public again in the summer of 2018. Shares ran higher on the initial offering, but have languished since then amid a broad market rally to new highs. I think investors are being a bit too pessimistic on BJ's and punishing the stock for sins of the past. As such, I see an attractive combination of value and growth potential, and think it is a buy.

Lots of growth ahead

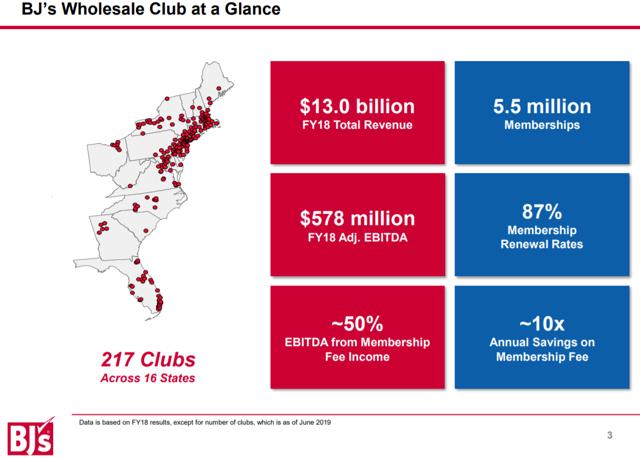

BJ's is a much smaller alternative to the other large warehouse clubs, Sam's (WMT) and Costco (COST). BJ's produces just over $13 billion in annual revenue and has 5.5 million members, a mere fraction of what Costco boasts.

Source: Investor presentation

In addition, BJ's is present only on the East Coast for the most part, whereas Sam's and Costco are essentially everywhere in the US. However, what BJ's lacks in size and scale, it makes up for with a strong value proposition for the consumer, growing membership renewal rates, and expanding margins.

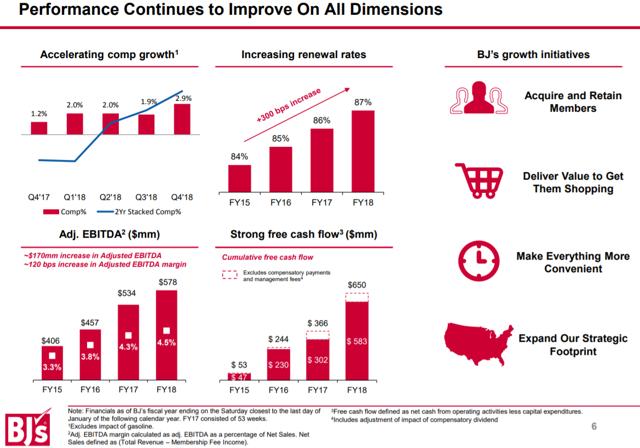

BJ's knows that its growth was broken prior to the IPO. However, management has been working to fix what was broken, and progress is certainly being made on a variety of fronts.

Source: Investor presentation

Comparable sales growth has been positive for five consecutive quarters, and not only that, but the rate at which comparable sales are improving has been rising. BJ's struggled in recent years with comparable sales, but management has been driving several initiatives to improve this critical metric, including focusing on convenience for the shopper, assortment, pricing, the consumer value proposition, and others.

This has led to attractive renewal rates among members that continue to grow. In fiscal 2015, BJ's sported a ho-hum renewal rate of 84%. Today, however, that is 87% and growing. BJ's is focusing on providing