Take care of your car in the garage, and the car will take care of you on the road. – Amit Kalantri

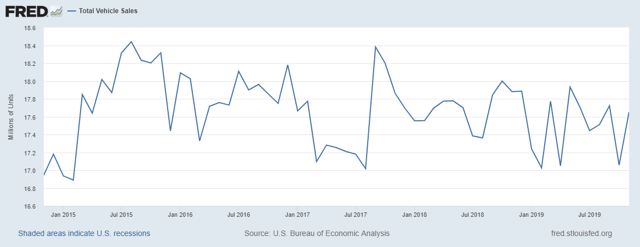

Penske Automotive Group, founded in 1990, has seen a steady increase in fortunes. Primarily a car and truck dealership, it has dealerships in the US, Canada and Western Europe that is included in the Fortune 500. However, vehicle sales in the US, mirrored in the other countries Penske is based, have been flat in the past few years. This is clear from FRED’s total vehicle sales statistics over the past five years.

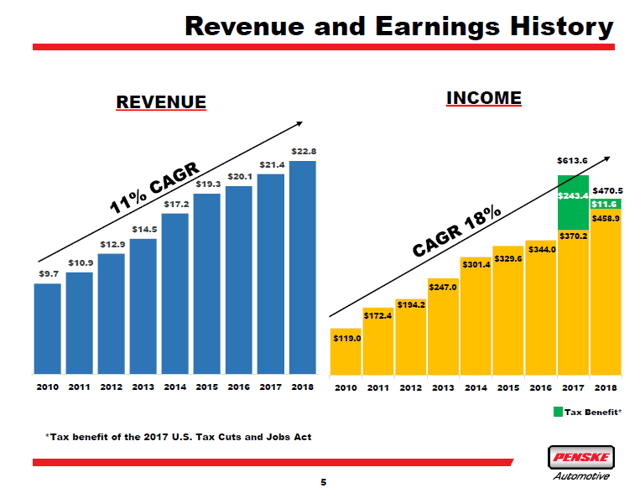

In such an environment, it would seem that automotive companies would be suffering. However, Penske’s revenue and earnings have continued to grow in this time period.

These two facts seem to be contradictory. However, the driver of earnings and revenue growth has not been in an increase in vehicle sales (same-store retail sales of new and used cars were flat in 3Q 2019), but in growth in its Parts & Services and Finance & Insurance businesses. This diversification has seen Parts & Services account for 45.8% of gross profit, with Finance & Insurance also becoming a significant source of profit.

In addition, the fundamentals of the business are likely to be improved as the trade war dampens. Chinese tariffs, as estimated by economist Michael Waugh, reduced US vehicle sales by $9.3 billion since being raised. If the tariffs are reduced due to a trade settlement being reached, the US consumer dependent on income raised from Chinese exports will have greater ability and inclination to purchase a new vehicle.

However, the share price has not followed the growth in revenue and earnings. Much like vehicle sales, it has remained flat through the time period. Does this present a buying opportunity? The RSI has fallen recently in line with a sell-off, indicating that the

How To Avoid the Most Common Trading Mistakes

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.