Introduction

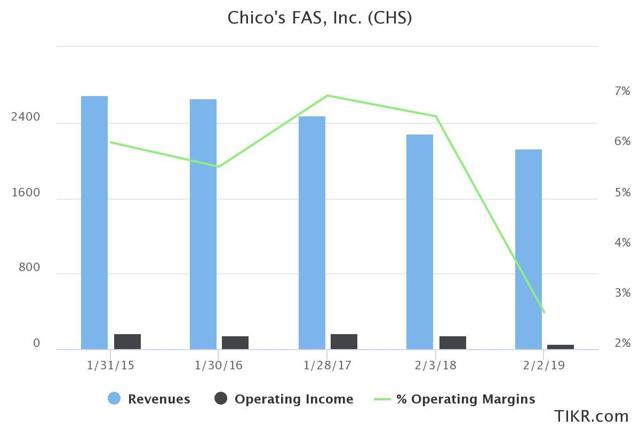

Chico's FAS (CHS) shares have plummeted sharply over the past several years as top and bottom-line declines spooked investors and confirmed fears of a retail apocalypse.

Shares have fallen considerably and consistently over the past six years from highs of close to $20 to current levels of ~$4. Much of this decline has been warranted due to operational underperformance, declining margins, and rabid competition from other e-commerce and brick & mortar retailers.

However, we believe that shares now embed a great deal of market pessimism and present an attractive risk-reward profile.

Source: TIKR

Business Overview

Chico's FAS is a retailer founded in 1983 that caters primarily to middle-aged (35+) women. The company operates a portfolio of brands that include Chico's, Soma, and White House Black Market (WHBM). Chico's and WHBM sell a wide array of privately branded clothing while Soma focuses exclusively on lingerie and sleepwear products.

The company operates 1,373 stores across 46 states and also sells DTC (direct-to-consumer) via websites for each of its brands.

Capitalization Table (numbers in millions)

| Share Price | $4.08 |

| Shares Outstanding | 114.74 |

| Market Capitalization | 468.14 |

| Debt | 46.25 |

| Cash and equivalents | 127.44 |

| Enterprise Value | 386.95 |

Source: TIKR

Source: Chain Store Age

Sales and Financial Position

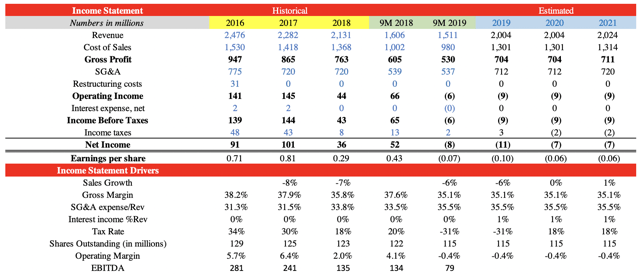

CHS generates roughly $2 billion in annual revenue, a figure that has declined steadily over the past few years alongside operating margins:

Source: TIKR

Chico's exemplifies why declining sales and consumer demand are so destructive to a company's equity price - declining sales force a company to ramp up promotional activity in order to stabilize its top-line, which reduces margins and operating profitability. This is exactly what has happened to CHS, which has been forced to combat weak sales with discounting in order to move product.

Source: CHS 10-K Filings

Gross margins have declined while