Introduction

Our goal is to present to you our IPO analysis for every new fixed-income security that enters the market and to find out if there is any trading potential. In this article, we want to shed light on the newest preferred stock issued by Gabelli Equity Trust (NYSE:GAB). Even though the product may not be of interest to us and our financial objectives, it definitely is worth taking a look at.

The New Issue

Before we submerge into our brief analysis, here is a link to the 497 Filing by Gabelli Equity Trust - the prospectus.

Source: SEC.gov

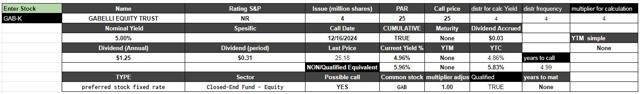

For a total of 4M shares issued, the total gross proceeds to the company are $100M. You can find some relevant information about the new preferred stock in the table below:

Gabelli Equity Trust Inc. 5.00% Series K Cumulative Preferred Stock (NYSE:GAB-K) pays a fixed dividend at a rate of 5.00% and has a par value of $25. The new preferred stock is not rated by the Standard & Poor's, but is anticipated to be rated an "A1" from Moody's Investors Service. The new IPO is callable as of 12/16/2024, and it is currently trading a little above its par value at a price of $25.18. This translates into a 4.96% current yield and a 4.86% yield-to-call.

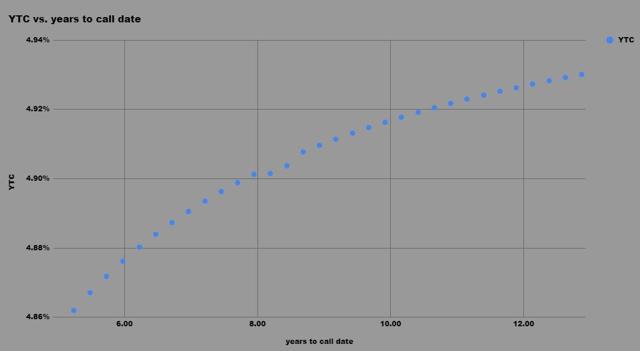

Here is the product's Yield-to-Call curve:

The Company

The Gabelli Equity Trust is a closed-end, non-diversified management investment company whose investment objective is long term growth of capital, with income as a secondary objective. Investments will be made based on management's perception of their potential for capital appreciation. The Fund seeks out undervalued companies with greater than average potential for growth. The Equity Trust maintains a 10% Distribution Policy whereby the Trust pays out to common shareholders 10% of its average net assets each year. This

Trade With Beta

Coverage of Initial Public Offerings is only one segment of our marketplace. For early access to such research and other more in-depth investment ideas, I invite you to join us at "Trade With Beta."