Introduction

Sanderson Farms (SAFM) had an excellent 2019 as its share price will end the year approximately 80% higher than where it started on Jan. 1. An excellent achievement, especially considering the negative impact of the higher corn prices in the final quarter of its financial year, caused by late harvests. 2018 was a weak year, 2019 was slightly better, but Sanderson Farms appears to be quite optimistic for the current financial year and beyond as it expects its EBIT and EBITDA to show a substantial increase.

2019 was a better year than 2018

It was a relatively weak fourth quarter where Sanderson Farms saw the market price for boneless breast meat for food service customers (requiring a big bird) decrease to historically low levels after Labor Day. This means the trend in 2019 was similar to 2018 when Sanderson also had to deal with a weak fourth quarter. Fortunately this was just a temporary issue as poultry prices started to increase again in November and December and Sanderson appears to be relatively optimistic about the start of the current financial year.

Source: financial statements

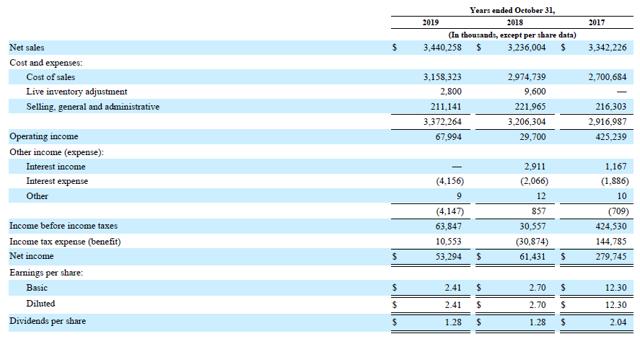

Back to FY 2019. Sanderson Farms reported revenue of $3.44B, an increase of just more than 6% compared to FY 2018, but unfortunately the cost of sales also increased by a similar percentage. However, the SG&A expenses fell by almost 5% and that saved the day as that kept the total increase of the operating expenses limited to just 5%. And the difference between a 6% revenue increase and a 5% increase of the operating expenses had a huge impact on the operating income of this low-margin business as the operating income more than doubled to just short of $68M.

Unfortunately the interest expenses increased, but Sanderson Farms was still able to report a pre-tax profit

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!

Take advantage of the TWO WEEK FREE TRIAL PERIOD and kick the tires!