Foreword

This article is based on two Kiplinger investing articles aimed at retirees:

25 Stocks Every Retiree Should Own, by Charles Lewis Sizemore, CFA, published 7/2/19, featured a "group of retirement stocks that includes both pure income plays and growth companies, with a focus on very-long-term performance and durability.”

20 Quality Dividend Stocks, (yielding roughly 4% or higher), published 8/13/18, by Brian Bollinger, "... should fund at least 20 years of retirement, if not more. They have paid uninterrupted dividends for more than 20 consecutive years, appear to have secure payouts and have the potential to collectively grow... dividends to protect investors’ purchasing power."

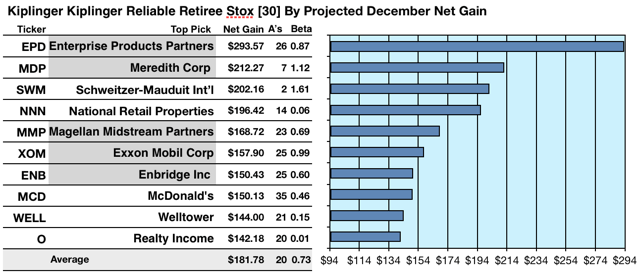

Actionable Conclusions (1-10): Analysts Estimated 14.22% To 29.36% Net Gains For 10 Top Kiplinger December Reliable Retirement Dogs Into 2020

Five of 10 top Kiplinger most reliable retirement stocks by yield were among the top 10 gainers for the coming year based on analyst one-year target prices. (They are tinted gray in the chart below.) Thus, the yield-based forecast for these late-December dogs was graded by Wall St. Wizards as 50% accurate.

Source: YCharts.com

Projections were based on estimated dividends from $1k invested in each of the highest-yielding stocks plus their aggregate one-year analyst median target prices, as reported by YCharts. Note: One-year target prices by lone analysts were not applied. 10 probable profit-generating trades projected to December 20, 2020 were:

Enterprise Products Partners (EPD) was projected to net $293.57, based on dividends, plus the median of target price estimates from 26 analysts, less broker fees. The Beta number showed this estimate subject to risk 13% less than the market as a whole.

Meredith Corp. (MDP) was projected to net $212.27, based on the median of target price estimates from seven analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk 12% more than

Get The Entire Kiplinger Reliable Retirement 'Safer' Dividend Dog Story

Click here to subscribe to The Dividend Dogcatcher. Get more information, the follow-up to this article, and a free two week trial.

Catch A Dog On Facebook At 8:45 AM every NYSE trade day on Facebook/Dividend Dog Catcher, A Fredrik Arnold live video highlights a portfolio candidate in the Underdog Daily Dividend Show!

Root for the Underdog. Comment below on any stock ticker to make it eligible for my next FA follower report.