Home bias in theory

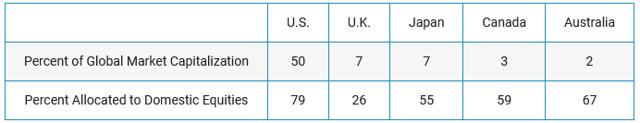

Home country bias is a global phenomenon, as most investors hold the vast majority of their wealth in the form of domestic assets. In a 2019 study, Vanguard found that in each case they examined, investors exhibited a strong home-country bias.

Exhibit 1: Home country bias

Regardless of where they live, investors have a significant opportunity to diversify their equity portfolios by investing outside their home market. Despite this opportunity, investors on average have maintained allocations to their home country that have been significantly larger than the country’s market-capitalization weight in a globally diversified equity index.

Investing outside one’s home market has diversified the returns of what had been a purely domestic market portfolio, on average and across time. The rationale for diversification is clear - domestic equities tend to be more exposed to the narrower economic and market forces of their home market while stocks outside an investor’s home market tend to offer exposure to a wider array of economic and market forces. These differing economies and markets produce returns that can vary from those of an investor’s home market.

There is no reason to have a home country bias - other than perhaps a small bias to take into account that investing in U.S. stocks is a bit cheaper than investing in international stocks. On the other hand, if you are still employed, it is likely your labor capital is more exposed to the economic cycle risks of the U.S. than to foreign market risks. If that is the case, once you include your labor capital as part of your portfolio, you should consider overweighting foreign markets to offset your labor capital risk.

“In theory there is no difference between theory and practice. In practice there is.” Yogi Berra.