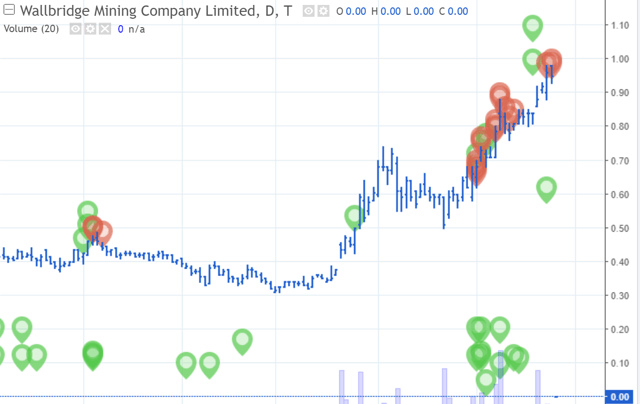

While quite a few juniors have seen significant insider buying in the past quarter like OceanaGold (OTCQX:OCANF), there are a couple of names where insiders have been selling heavily despite the recent uptick in gold (GLD) prices. In the first instance, it's not surprising, as Wallbridge Mining (OTCQB:WLBMF) is both overvalued and overextended as it's surpassed a $500 million market cap as an explorer. In the second instance for HighGold Mining (HGGOF), it's a little concerning as the stock had just seen its IPO debut a few months ago, and some insiders are already anxious to cash in quite a few shares. Insider selling alone is not always a reason to sell, but it's often a red flag if the selling is persistent. In the case of Wallbridge Mining and HighGold Mining, the frequency and size of sales are undoubtedly persistent. Based on this, I see Wallbridge Mining as an Avoid and further strength in HighGold Mining above C$1.65 as a profit-taking opportunity.

(Source: INK Research, CanadianInsider.com)

(Source: INK Research, CanadianInsider.com)

It's been a busy quarter for insiders at several different companies, with insiders at a few of the more beaten-up miners putting some cash to work on the buy-side. OceanaGold is one such name, with 400,000 shares purchased by insiders in the past 30 trading days alone. The purchases have ranged from prices of C$2.32 to C$3.05, and represent over C$1 million worth of buying. In total, this represents about less than 0.1% of the company's total shares outstanding (~620 million), but is a subtle vote of confidence, to say the least. On the selling side, however, there are two companies with above-average insider selling in Q4, and one with persistent selling all month. These two names are Wallbridge Mining and HighGold Mining, with the former being an explorer with a high-grade discovery in Quebec, and the latter being a new IPO that debuted in Q3 on the Canadian market. Let's take