It looks as if the market has finally recognized the potential investment opportunity NantKwest (NK) has to offer. During the past three months, NK has climbed more than 150% to hit a new 52-week high of $3.58. This strong move to the upside has been fueled by impressive data releases and presentations. The biggest move followed a company press release announcing NK’s Phase Ib data for their off-the-shelf NK, a checkpoint inhibitor, antigen stimulation through adenovirus therapy. The company reported impressive results that showed complete responses in TNBC patients who failed the standard of care. In addition, they revealed an ongoing survival to date of 78%. It appears the market is finally waking up and is starting to recognize NK’s potential to be a key player in oncology and a lucrative investment.

I intend to review the recent press releases and why the data is so important. In addition, I take a look at the charts to identify some key areas for investors who are looking to manage their position. Finally, I discuss my plans for my NK position for 2020.

Looking at the Data

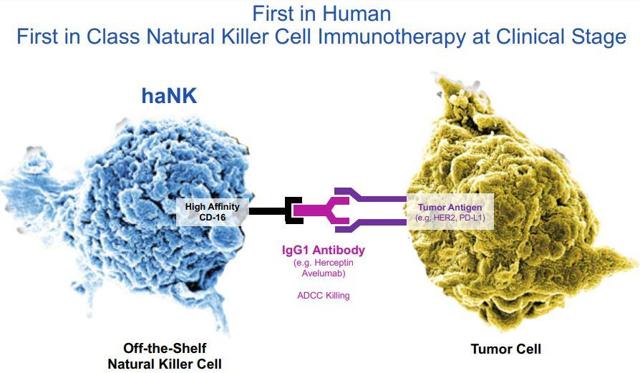

Back on Dec. 16, NantKwest announced results from their Phase Ib trial their first-in-human immunotherapy that comprised of NantKwest’s haNK cells joined with ImmunityBio’s N-803 agent, a chemoradiation therapy, adenoviral and yeast tumor-associated antigen vaccines, and a PD-L1 checkpoint inhibitor in relapsed metastatic triple-negative breast cancer “TNBC” patients.

Figure 1: haNK vs Tumor Cell (Source: NK)

The data was beyond impressive, with disease control in seven of nine patients and overall response in six of nine patients. What's more, two out of nine patients have an ongoing complete response with durations ranging from eight to 11 months and a third patient representing a near-complete response. At the time of the press release, seven of the nine patients were alive with