I’ve long been bearish on fast casual chain Noodles & Company (NASDAQ:NDLS). The stock has been egregiously valued for most of the company’s life as a publicly-traded entity, despite massive shareholder wealth destruction that has already occurred. However, the situation is on the mend, and for the first time in a very long time, I think Noodles is worth a look on the long side. To be fair, I’m not overly bullish, and this is a turnaround situation that is fraught with potential risk. But the reward if it works is huge, so those interested in owning the stock may find value in it today.

Years of mediocrity, but green shoots emerge

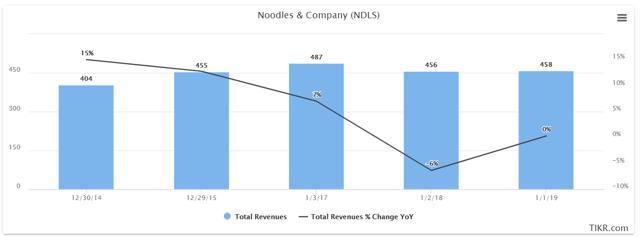

Noodles has struggled in the past couple of years with revenue generation, and as a result, its profitability has suffered as well. The company set enormously ambitious store growth goals in the first couple of years after it went public – stating it wanted 2,500 stores over time – and with just under 20% of that goal complete even today, investors were enamored with something that was doomed before it began. However, Noodles has closed weak stores and is making good progress, trying to remedy the situation below.

Source: TIKR.com

Above we have Noodles’ revenue in millions of dollars for the past five years, as well as the year-over-year change associated with its top line. Store growth and comparable sales increases gave way to neither of those things in 2017 and 2018, leading to 2018’s revenue being almost exactly equal to 2015’s. That’s not great, but Noodles also did what it needed to do, which was slow down on ridiculously quick growth plans and close underperforming stores, while also improving its menu. Adding things like its Zoodles to the menu has seen its traffic improve markedly, and the revamp is performing quite well.