Convenience store chain Murphy USA (NYSE:MUSA) has been on quite the run this year. Shares began 2019 at just over $75 and are ending it near $120. The gain is thanks to much-improved fundamentals – particularly on its fuel business – and investors are clearly enamored. However, as we’ve seen with Murphy in the past, tailwinds like this one tend to be transitory, and as a result, I think shares have been bid up too much today. I believe Murphy is fairly valued at best, and perhaps a bit expensive at worst, but either way, investors should take profits and wait for a pullback.

Volatility abounds

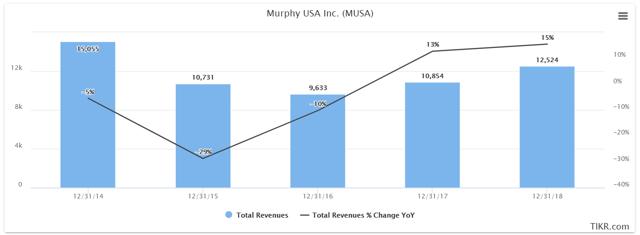

One thing Murphy has always done is produce wildly different revenue totals from year to year. The primary cause of this is its fuel business, which tends to be extremely volatile for anyone. Indeed, this is why chains like Costco (COST) and Kroger (KR), among others, report sales “ex-fuel” in most cases. Given that this is a primary channel of revenue for Murphy, it makes sense we’d see huge swings from year to year based upon volumes and pricing, and that is exactly what we can see below.

Source: TIKR.com

Above we have revenue in millions of dollars, as well as the year-over-year change associated with the company’s top line. Revenue has seen enormous changes in past years based upon the two factors I mentioned – volume and pricing – and this year is no different. After a -29% showing in 2015, followed by a 10% decline in 2016, revenue was up 13% two years ago and 15% last year. This year, however, revenue is slated to be fractionally lower than 2018.

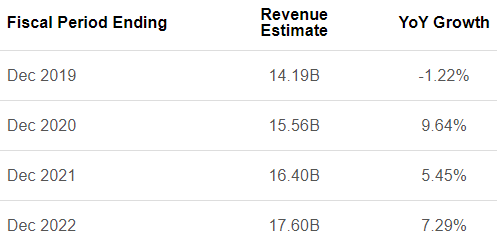

Source: Seeking Alpha

So far this year, Murphy has managed to boost its merchandise revenue by a very strong 7.7%, driven by