Note: All amounts discussed are in Canadian dollars

While the US stock market had a rather dizzying 2019, the TSX lagged rather substantially. A key aspect in the lag was the underperformance of energy shares which heavily dominate the TSX.

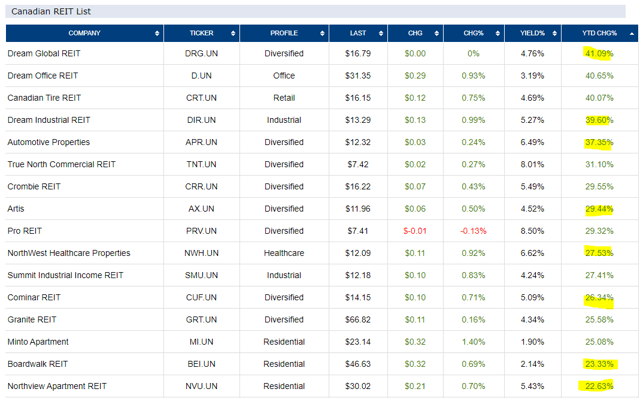

Within our Canadian portfolio, we felt the drag from energy names as well. But one area where we had significant outperformers, was in the REIT space. Below we can see the top performers in Canada in the REIT sector. That change represents the price change only. Adding in dividends you can see that some Canadian REITs packed quite the punch for 2019.

Source: Reit Report

While we basked in the phenomenal performance of the winners, we were forced to prune most of our holdings (highlighted above) down to minimal levels as we are starting to see rather compelling values elsewhere. This has got our Canadian REIT holdings from over 45% at the beginning of the year to under 10%. When you combine those numbers with the percentage appreciation we have seen, you can tell we have been selling, and selling hard.

One area that we have added

While Canadian REITs have done well, we do have some rather notable laggards.

Source: Reit Report

H&R REIT (OTCPK:HRUFF) is one that has barely managed to stay flat. While it does sport a rather hefty yield, its underperformance does present an opportunity in our view.

The company

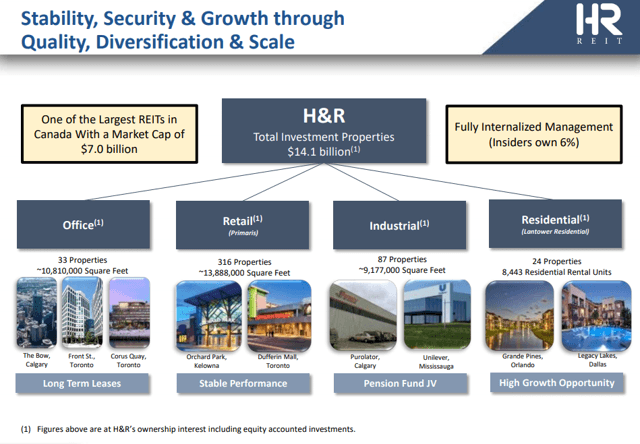

H&R is one of the largest Canadian REITs with a $7 billion market capitalization.

Source: H&R REIT

It is diversified across all areas of real estate with offices forming more than 40% of its asset value.

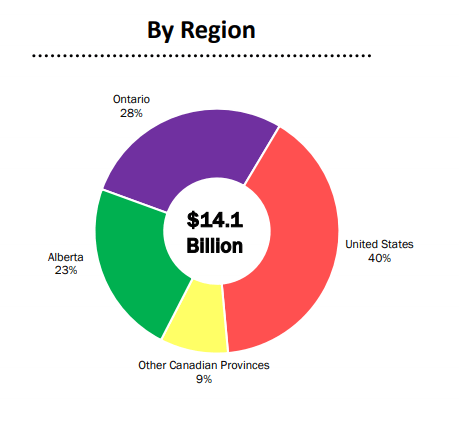

Source: H&R REIT

Geographically, the US portfolio makes up 40% of its asset base and it has a major presence in Ontario and Alberta.

Source: H&R REIT

The recent performance

High Dividend Opportunities, #1 On Seeking Alpha - 20% Off Till year-end!

HDO is the largest and most exciting community of income investors and retirees with over +3800 members. We have a Canadian ideas room as well as one specifically for Option trades. Our Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!