Source: VendingMarketWatch.com

Keurig Dr Pepper (NASDAQ:KDP) has now been trading publicly for well over a year. The company was a combination of brand powerhouses that many of us are familiar with. The shares quickly appreciated due to investor hopes for impressive performance and above average growth in the consumer packaged goods category. As the company has reported several quarters of results now, it is clear that the growth may not be as consistent and great as hoped for. However, the company recently reported results that showed some hope for growth as volume and margins both expanded. One quarter of results does not mean consistency however. As the shares have seemingly missed out on the market rally to new highs, I look for an entry point into the company. I would like to see another quarter of consistent growth before paying more than $26 per share though.

KDP Performance

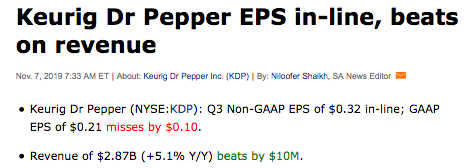

Keurig Dr Pepper recently reported results that looked pretty strong.

Compared to the prior year period, sales grew 5.1% to $2.87 billion, operating income increased 68% to $580 million and EPS grew 91% to $0.21. However, this is reflective of adjusted earnings due to the newly formed company at the time. Operating income increased 180% to $498 million, and adjusted EPS increased 6.7% to $0.32. Overall, the company seemingly reported great results. But a deeper look warrants caution. The gains were driven by increased volume of 1.5%, however, more was driven by higher net prices of 1.6%. Also benefiting the quarter was a 0.3% impact from an additional shipping day. The growth of sales in every operating division enabled the company to generate strong results, cash flow, and debt reduction. For the first nine months of 2019, free cash flow was $1.6 billion and the company reduced debt by $788 million.